2016 CEO Pay Trends Report

Posted by Gerard Leider on June 21, 2016 in Thought Leadership

All data, graphs and charts reprinted with permission of Equilar.

Executive Summary

The CEOs of the largest U.S. public companies may differ in their career paths—founders who began with the spark of an idea, rank-and-file employees who ascended the corporate ladder, or established business leaders or board members who welcomed a new opportunity—but they all share the responsibility of leading organizations that help keep the economy churning. Though they sit at the top of the corporate hierarchy, CEOs are held accountable by their bosses—the company’s shareholders and their fiduciaries serving on the board of directors.

In 2011, the introduction of regulations providing shareholders the right to an advisory vote on executive compensation—better known as Say on Pay—brought increased scrutiny of CEO pay packages in the wake of the financial crisis and Dodd-Frank legislation. Say on Pay altered the standards of corporate governance, which are now increasingly viewed through the lens of compensation awarded to CEOs as an indicator of a company’s overall corporate citizenry.

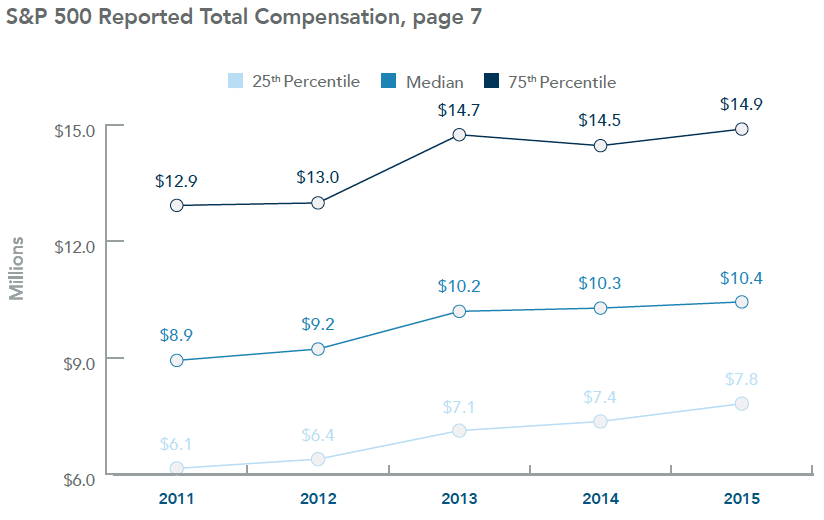

Investors and proxy advisors have always expected a strong connection between a company’s performance and the CEO’s pay, but the pressure for public companies to connect pay for performance has intensified in the past five years. This trend has not curbed the rise of CEO pay—which has grown modestly each year since 2011 for S&P 500 chiefs, reaching a median $10.4 million in 2015 according to the SEC’s definition of reported pay—but it has caused a shift in the way companies deliver compensation to CEOs.

CEO pay is increasingly at-risk, and variable components dependent on meeting or exceeding performance goals now comprise a larger share than they once did. Pay that is fixed, or dependent only on the CEO’s continued employment, has not vanished but now makes up a much smaller percentage of total compensation than in past years.

The data in this report examines CEO pay for S&P 500 companies—defined as reported compensation in the summary compensation tables (SCT) within annual SEC proxy filings (DEF 14A)—over the last five fiscal years. In that time, the U.S. stock markets have recovered from previous lows during the financial crisis, and in tandem with the recovery, reported CEO pay increased every year—the largest period of growth coming between 2012 and 2013 when reported pay was 10.5% larger at the median.

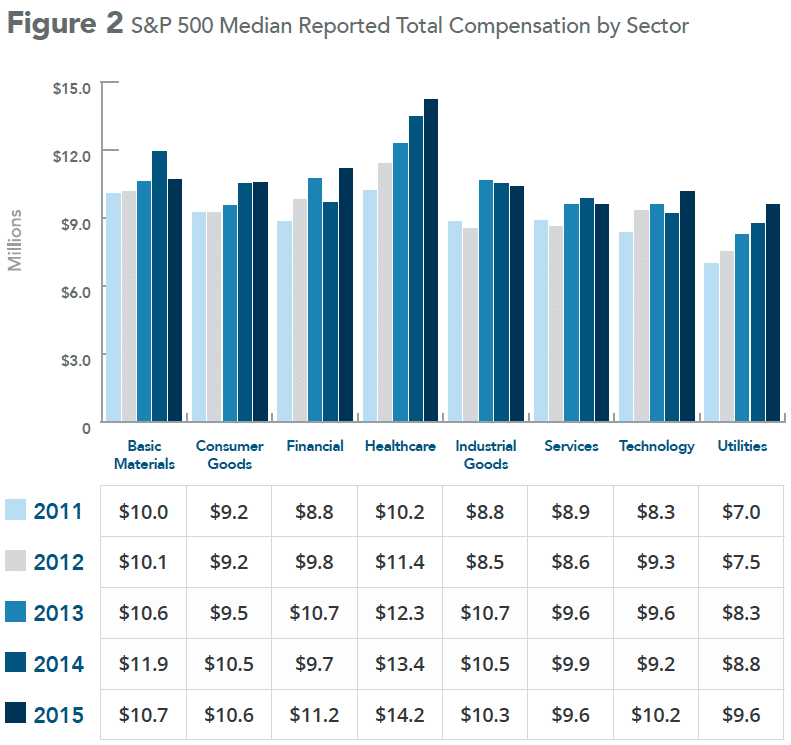

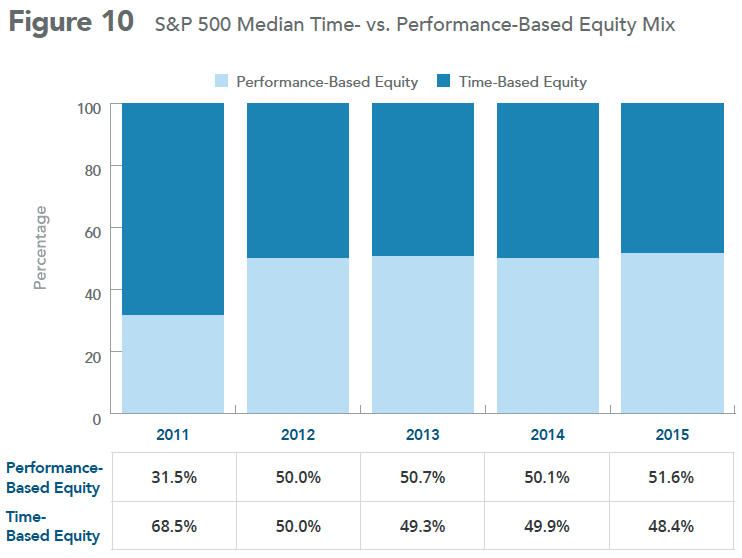

This report also visualizes shifts in how companies award CEO pay. Changes to CEO base salary and annual cash bonus payouts were relatively stagnant compared to the value delivered by equity-based compensation (i.e. stock and options awards). As equity-based pay awards have increased, so has the proportion delivered in performance-based awards—contingent on meeting or exceeding performance goals set by boards of directors. In 2015, 51.6% of median S&P 500 CEO reported equity compensation was contingent on performance incentives, compared to just 31.5% in 2011.

[su_service title=”CEO PAY WEBINAR” icon=”icon: money”]

Join Equilar and Meridian Compensation Partners for a webinar that takes a look inside the newest CEO pay data reported in 2016 proxy statements, and learn from a lively discussion that looks beyond the reported pay figures at the regulatory requirements, governance issues and changing market practices.

Register at Equilar.com.

[/su_service]

Methodology

Equilar’s CEO Pay Trends 2016 examines the compensation of CEOs at current S&P 500 companies, and tracks this data for those companies over the last five fiscal years. Fiscal years are defined by proxy filing dates between May 1st of the fiscal year and April 30th of the following calendar year. Only CEOs who served for their company’s entire fiscal year were included in the applicable study fiscal year in order to preclude pro-rating or projecting elements of compensation for the sake of comparison.

Total compensation is defined as the sum of summary compensation table (SCT) reported salary, bonus, non-equity incentive plan compensation, stock awards, option awards and all other compensation—change in pension value and nonqualified deferred compensation was excluded to omit changes in actuarial value. The term “stock” used throughout the report comprises all full-value shares, including restricted stock and restricted stock units. Performance-based equity refers to all equity compensation vehicles linked to the achievement of a performance metric. Industry sectors are based on Yahoo! Finance classifications—conglomerates were excluded from charts throughout the report due to small sample size, but were included in the overall figures.

The narrative portion of this report identifies trends in how companies award CEO pay as they are required to disclose it to the SEC. Meridian Compensation Partners has offered independent commentary to provide color and context to nuances on how those compensation awards are structured and eventually paid to CEOs.

Source: Equilar. Copyright 2016.

Total Compensation

Overall, S&P 500 companies have bolstered their CEOs’ pay packages in each of the past five years, signaling continued focus on awarding compensation as motivation for performance and retention. Despite volatility in the markets, median CEO total compensation in the S&P 500—as reported in proxy statements’ summary compensation tables (SCT)—was 1.6% higher in 2015 than 2014—totaling $10.4 million vs. $10.3 million the year prior.

The largest changes as a percentage of total compensation occurred at the lower end of the pay scale. From 2014 to 2015, pay at the 25th percentile saw the largest increase at 6.2%, whereas pay at the median and 75th percentile increased 1.6% and 3.0%, respectively.

Data Points

- Across the entire study range, median reported CEO pay was 16.9% higher in 2015 than in 2011, representing a 3.98% compound annual growth rate (Fig. 1)

- Average total compensation for the S&P 500 in 2015 was $12.0 million, 1.1% lower than 2014

Source: Equilar. Copyright 2016.

Meridian Compensation Partners Commentary

Proxy reported total compensation increased slightly from 2014 to 2015 at the median for a S&P 500 CEO, moving from $10.3 million to $10.4 million. This modest total increase is slightly below the typical 3% merit salary increase budget that most employees have experienced over the last several years. When comparing proxy-reported total compensation, it is important to realize that this number represents a combination of actual cash payouts impacted by company or individual performance and a long-term grant date accounting value.

When looking at CEO compensation, there are two ways to frame it. You can view CEO compensation in terms of actual payouts or in terms of structure/target opportunity. However, the proxy summary compensation table disclosure is a mixed comparison of both actual and target accounting value, showing actual base salary, actual paid annual & long-term cash payouts and an estimated grant date accounting value of other long-term incentives—face value of restricted stock, Black-Scholes value of options and target face value of performance plans. Typically, growth in target compensation is a reflection of market competitive norms, job complexity, risk profile and retention efforts, while actual pay is a reflection of company and industry performance.

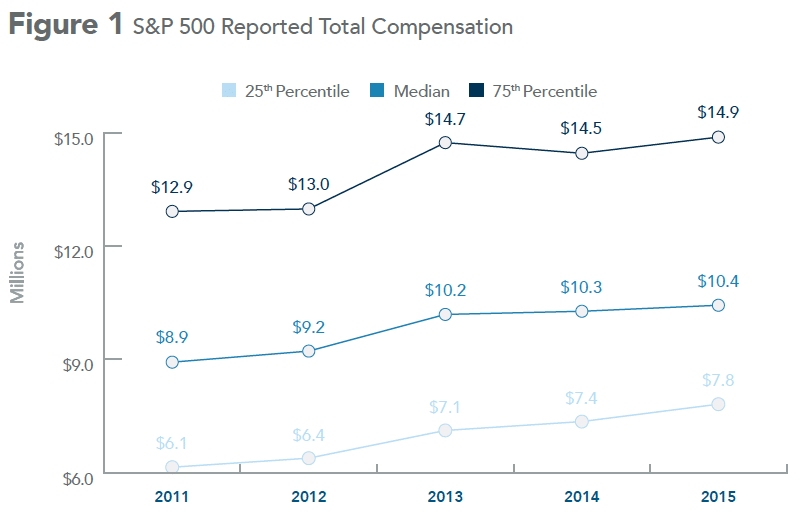

While overall reported CEO pay rose at the median from 2014 to 2015, it was not universal across industries. Amidst increased mergers and acquisitions (M&A) activity in pharmaceuticals, median CEO total compensation in the healthcare sector continued the steady growth it has seen for several years, up 5.6% from $13.4 million in 2014 to $14.2 million in 2015. That said, growth in the healthcare sector did slow from 2014 and 2013 levels when it increased 9.5% and 7.7%, respectively.

Median reported CEO pay saw the largest changes in the basic materials and financial sectors. The former was 12.6% higher in 2014 than 2013—up from $10.6 million to $11.9 million, only to decrease 10.2% to $10.7 million in 2015. The financial sector behaved differently, when pay in 2014 was 9.8% lower at a median of $9.7 million than in 2013 at $10.7 million. The financial sector rebounded in 2015 when pay rose above 2013 levels to $11.2 million—15.5% higher than the 2014 median and the largest year-over-year differential from 2014 to 2015 of any sector.

Data Points

- The healthcare sector saw the largest change in median reported pay levels from 2011 to 2015, increasing by 39.1%, while the basic materials sector increased 6.5% over that time frame, the smallest overall change (Fig. 2)

Source: Equilar. Copyright 2016.

Meridian Compensation Partners Commentary

If the company is growing and performing well, which has been the case for most healthcare and technology companies in the recent past, then in turn compensation levels both target and actual compensation should be higher.

A second reference point that should be considered when thinking about compensation growth at both the technology and healthcare industries is that both of these industries have been particularly acquisitive, leading to growth in company size and complexity through both acquisition and organic growth. In the end, these industries have grown at a greater pace than general market and often into larger organizations with larger revenues, global footprints and company structure complexities. Higher compensation can be expected in these situations.

Large fluctuations for other sectors are reflections of industry performance. Median pay as defined by the summary compensation table has fluctuated as a result of the actual payouts on the annual bonus, long-term cash plans and grant date opportunity value of the long-term incentive (LTI) awards. Keep in mind the grant date value for options is impacted by Black-Scholes value that incorporate stock price volatility, which is low against historical norms for many industries. Furthermore it is important to recognize the substantial decline in basic materials valuations, due to price declines in commodities, especially oil.

Pay Components

Stock award grant values increased over the past five years and often comprise a majority of CEO pay. The preference for stock awards is due in part to the residual impact of accounting rule changes for expensing equity in 2006 and the push to align executives with shareholders through equity ownership. The rigorous alignment of CEO pay with company performance by making performance stock awards contingent on performance results

served as a strong influence in the wake of Dodd-Frank, Say on Pay and proxy advisor pay-for-performance guidelines.

In addition, the required Say on Pay vote has put greater scrutiny on executive compensation. Shareholders and proxy advisors have taken the position that a significant portion of equity awards should be performance-based, many of whom consider stock awards more effective than options to achieve this goal, resulting in a decrease in median value of options awards.

Changes to other pay components of CEO pay at the median have been less dramatic over the past five years. The growth in median base salaries awarded to CEOs remains minimal, and compensation awarded in the form on bonuses has fluctuated slightly, showing a lower value between 2011 and 2012, higher in both 2013 and 2014, before declining again in 2015. Other compensation, including benefits and perquisites values, has remained relatively steady over the five-year study period overall while fluctuating slightly from year to year.

Data Points

- The median grant-date value of option awards in the S&P 500 was 34.1% lower in 2015 compared to 2011 (Fig. 3)

- Median stock grants in 2015 were $5.1 million, 8.2% higher than 2014, the largest year-over-year difference among all pay components (Fig. 3)

Source: Equilar. Copyright 2016.

Meridian Compensation Partners Commentary

We need to be careful when we define a component of pay as stock awards similar to what is discussed in the summary compensation table. There are two types of stock awards—time-vested and performance-vested—and both have grown in prevalence for different reasons. Time-vested equity, typically referred to as restricted stock or RSUs, takes on a primary goal of talent retention given the lack of performance required to earn the grant, even in a declining market. These awards will change in value but vest based on the passage of time. In contrast, performance equity, or otherwise defined as performance shares/units, are only earned when certain goals are achieved over the measurement period, requiring goals to be set and achieved before payout.

Performance equity has substantially increased in prevalence as a result of shareholder demand to align CEO compensation with company performance. Another contributing factor to the growth of performance equity is that investor advisory firms like ISS or Glass Lewis do not consider stock options a performance-based LTI vehicle.

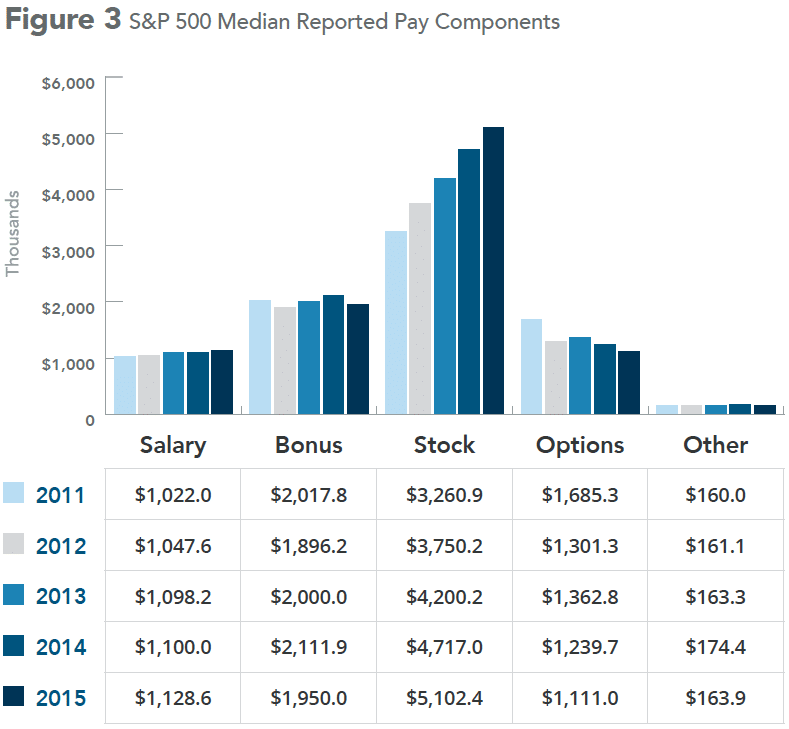

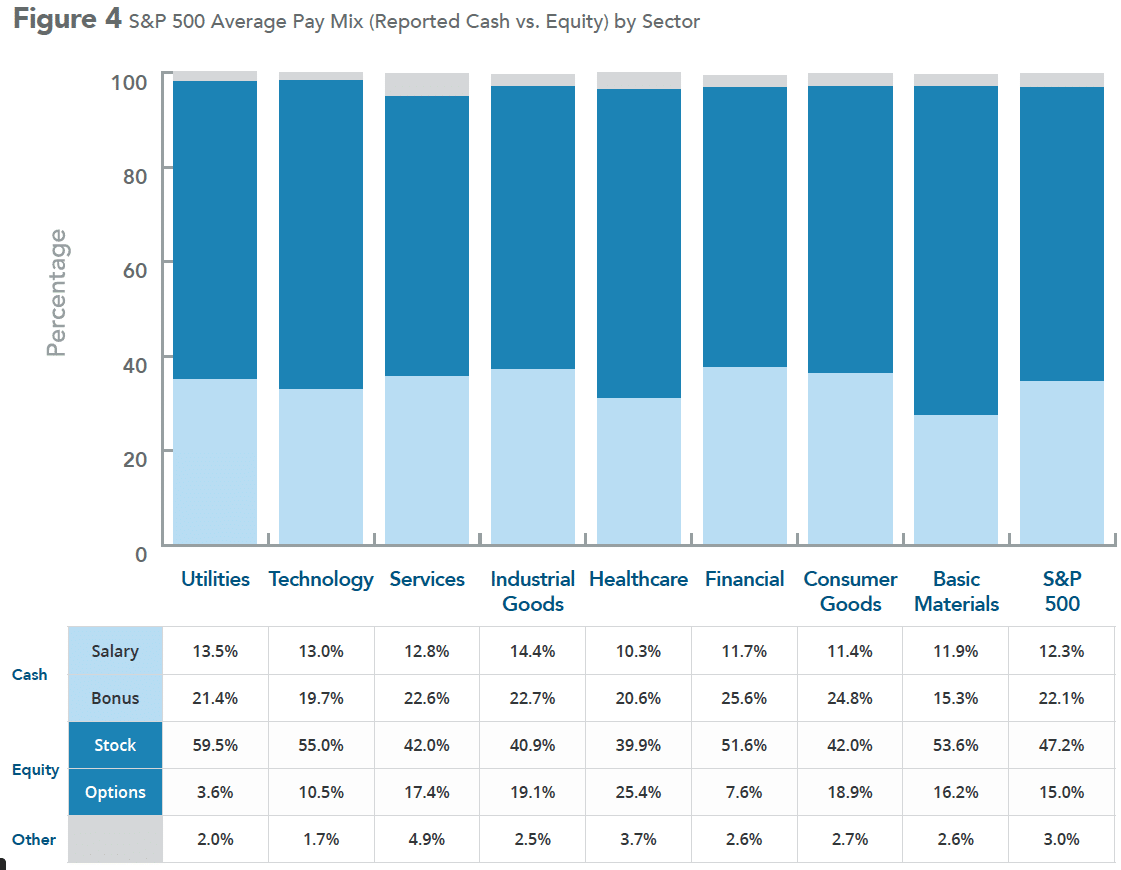

In 2015, equity remained the largest component of compensation for CEOs, and comprised the majority of compensation across all sectors. However, there is significant variation in the breakdown of compensation between cash and equity across industries in the S&P 500.

Cash was given greater weight in the industrial goods and financial sectors. The starkest difference between the weighting of cash versus equity in compensation structure is seen in the basic materials, healthcare and technology sectors.

Data Points

- The basic materials and technology sectors had the highest portion of total reported compensation valued in equity at 69.7% and 65.5% of the average pay mix, respectively (Fig. 4)

- The utilities sector was the closest to the S&P 500 index in terms of overall pay mix with 34.9% cash and 63.1% equity, compared to the S&P 500 average pay mix overall—34.4% cash and 62.2% equity (Fig. 4)

- Stock award values comprised the largest percentage of total compensation in the utilities sector, averaging 59.5% of reported CEO pay at these companies (Fig. 4)

- Option grant value as an average percentage of total compensation varied widely across sectors. While options comprised only 3.6% of CEO total compensation in the utilities sector on average, options comprised 25.4% of reported CEO compensation at healthcare companies on average (Fig. 4)

- The only sectors where options represented a higher average percentage of total CEO compensation than annual bonus payout were the healthcare and basic materials sectors (Fig. 4)

Source: Equilar. Copyright 2016.

Annual Cash Bonuses: Plan-Based vs. Discretionary

Increasing shareholder activism, proxy advisor scrutiny and SEC regulation is affecting CEO compensation structures, including annual cash bonuses. Pay for performance is becoming a greater priority for public companies, and this is displayed in the shift away from discretionary bonus awards to heavy reliance on plan-based annual incentive awards, commonly known as non-equity incentive plan (NEIP) compensation. Annual cash bonuses viewed as misaligned with company performance may draw the attention of proxy advisors and, in some cases, result in a recommendation that shareholders vote against Say on Pay.

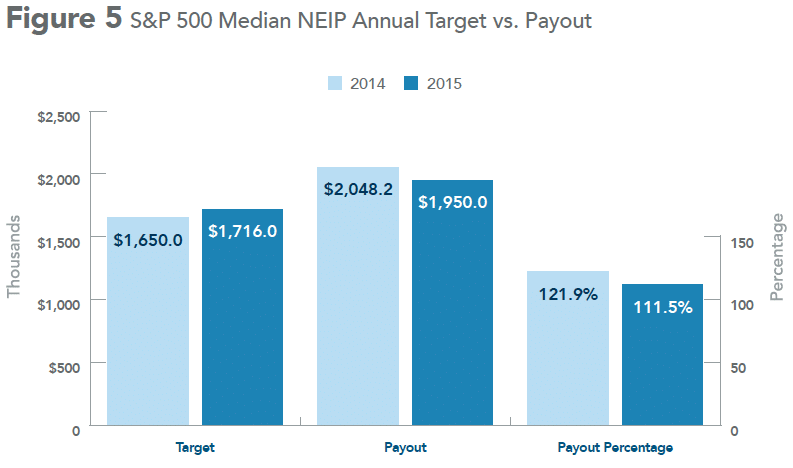

Over the past two years, the number of S&P 500 companies offering plan-based annual cash bonuses remained stable at 87.4% of companies in both 2014 and 2015. The median value at target—or the amount coinciding with targeted performance goals—increased by 4.0% from 2014 to 2015, while the median value at payout—or the amount actually earned based on performance results—decreased by 4.8% over the past fiscal year. Similarly, the median payout as a percentage of target decreased by roughly ten percentage points, suggesting that economic volatility resulted in lower payouts. Despite the decrease in payouts as a percentage of target bonus amounts, at least a quarter of plan-based annual cash bonuses paid out more than 50% above target in both years.

Data Points

- While the median NEIP payout as a percentage of target fell from 121.9% in 2014 to 111.5% in 2015, the majority of plans continue to pay out above target (Fig. 5)

- After surpassing $2.0 million in 2014, the median NEIP payout fell below that mark in 2015 (Fig. 5)

Source: Equilar. Copyright 2016.

Meridian Compensation Partners Commentary

Designing appropriate CEO pay packages is all about pay and performance. First, companies need to examine the level of performance-based pay and retention needed. As an example, over the last several years many organizations have reviewed the balance between time-vested equity and performance-based equity.

Second, organizations continue to relook at what metrics are being used for both short- and long-term incentive plans. Profit measures, like operating income and earnings per share (EPS) and growth metrics such as sales and revenues are the most prevalent when looking at annual bonus plans, while long-term plans tend to focus on profit and return metrics, along with relative total shareholder return (TSR).

Lastly, over the last several years given market uncertainty, business volatility and the difficulty of establishing long-term measureable goals, many organizations have moved toward relative performance against a peer group. The vast majority of companies who have moved toward using relative performance have chosen TSR to align with stock price performance and distributions to shareholders.

Bottom line, organizations need to continue to align goal setting as it relates to the payout relationships at, above and below target relative to company performance. Although discretion (both positive and negative) is not commonly used at the end of the performance period to establish the final payout, companies should be using discretion to ensure the right messages and payouts are being delivered relative to the company’s business strategy and financial results.

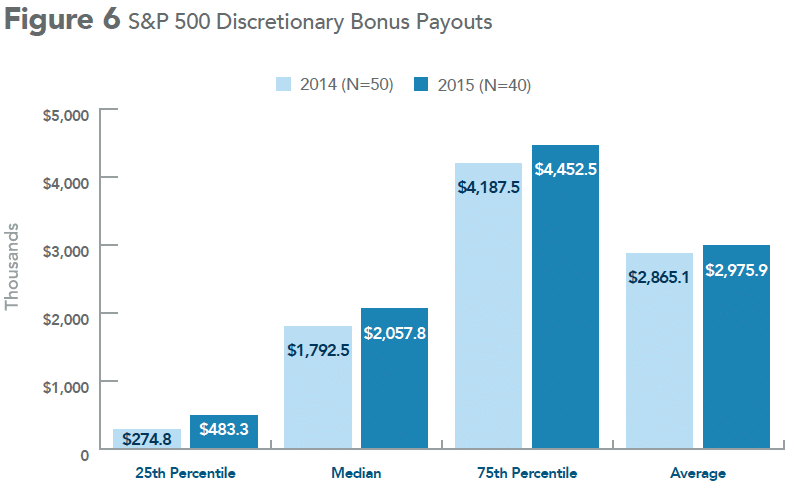

Discretionary annual cash bonuses are giving way to NEIP compensation, but a smaller slice of the S&P 500 continues to award them to their CEOs. Companies commonly grant discretionary bonuses to their executives during transitions, difficult market conditions, restructuring, or when facing otherwise unusual or challenging obstacles. Discretionary bonuses afford companies the flexibility to complement CEO pay when appropriate, even if the bonus amount may not qualify for deductibility under the U.S. tax code.

Data Points

- The percentage of S&P 500 companies awarding discretionary bonuses fell from 11.3% in 2014 to 9.2% in 2015 (Fig. 6)

- The median discretionary bonus—of companies granting such bonuses—was $2.1 million in 2015, up from $1.8 million in 2014 (Fig. 6)

- Discretionary bonuses at the median and 75th percentile were higher by approximately $250,000 each in 2015, while the 25th percentile increased slightly less (Fig. 6)

Source: Equilar. Copyright 2016.

Performance Equity

Companies generally grant equity awards in the form of time-vesting stock, time-vesting options or performance-based equity. Vesting of performance-based equity awards is ultimately dependent on pre-determined performance conditions, and most often takes the form of restricted stock or restricted stock units (“stock”) or—less commonly—options.

Over the past five years, coinciding with the passage of Dodd–Frank and the resultant implementation of mandatory shareholder votes on executive compensation (Say on Pay), there has been an increasing emphasis on “pay for performance,” or tying CEO compensation to actual measures of company performance. During this period, shareholder interest in companies’ pay practices has helped drive the shift towards performance-based equity compensation.

While the treatment of time-vesting stock options as “time-based” rather than “performance-based” awards is not universally accepted, it appears that the industry has become less sympathetic to the argument that stock options are inherently performance-based awards. As an illustration, the proxy advisory firm Glass Lewis, which has historically excluded time-vesting stock options from performance-based compensation calculations, actively removed the following text from its 2012 Proxy Paper Guidelines in the 2013 Guidelines:

“We favor the grant of options to executives. Options are a very important component of compensation packages designed to attract and retain experienced executives and other key employees. Tying a portion of an executive’s compensation to the performance of the company also provides an excellent incentive to maximize share values by those in the best position to affect those values. Accordingly, we typically vote against caps on executive stock options.”

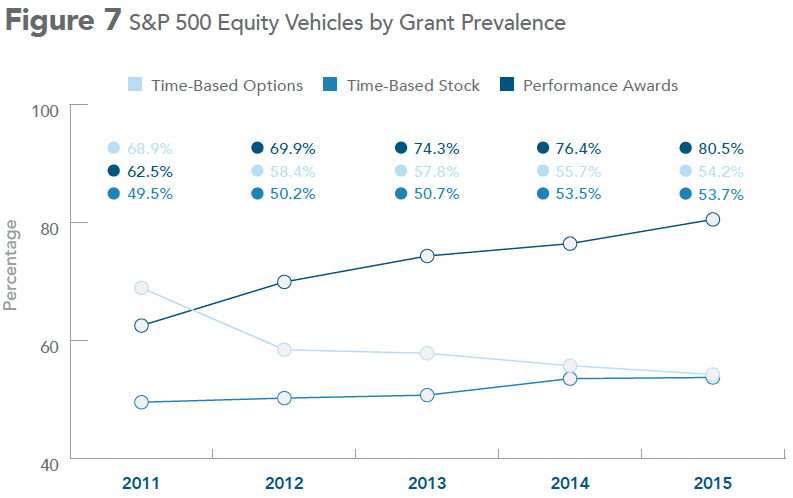

The ongoing shift from time-vesting options to performance-based equity and, to a lesser extent, time-based stock continued in 2015. The prevalence of options, the primary equity vehicle awarded by S&P 500 companies in 2011, fell 14.7 percentage points between fiscal 2011 and 2015. Meanwhile, the share of S&P 500 companies granting performance-based equity increased from 62.5% in 2011 to 80.5% in 2015. While the prevalence of companies granting time-vesting options was nearly 20 percentage points higher than those granting time-vesting stock in 2011, the prevalence of these time-vesting equity awards has converged over the past five years, with roughly 54% of the S&P 500 offering each equity vehicle to CEOs in 2015. (Fig. 7)

Source: Equilar. Copyright 2016.

Meridian Compensation Partners Commentary

The initial change in equity mix shown in the data started in the mid-2000s when FAS 123R changed the accounting standards for stock options. Following that change options had an accounting expense and the playing field to use stock options, time-vested restricted stock or performance shares from an accounting perspective was leveled. The more recent changes have been influenced by institutional advisory firms like ISS and Glass Lewis that believe options are not performance-based pay, and the demand by institutional shareholders to build stronger link to company performance and incentive payouts. In addition, as more organizations increase the use of performance awards, the market has also changed the type of goals being used within long-term performance plans. Relative goal-setting against an industry peer group has grown significantly, especially in designs measuring total shareholder return (TSR).

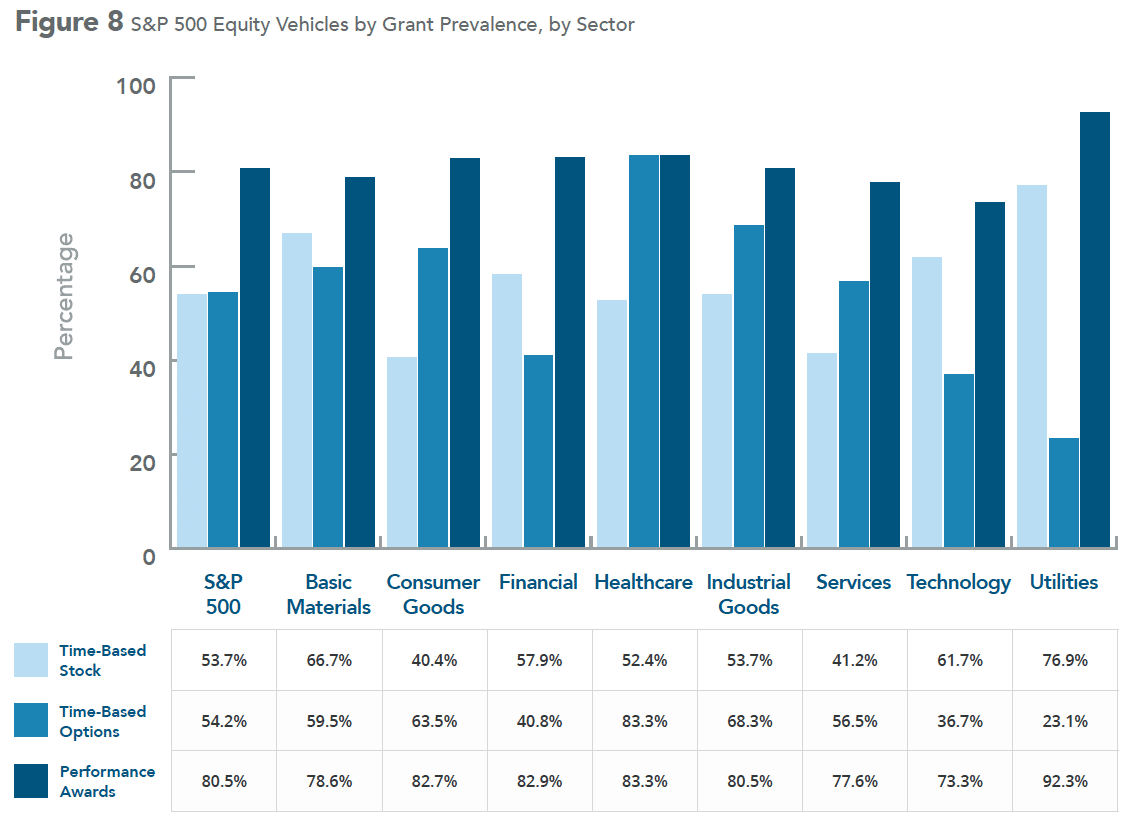

Consistent with the composition of equity compensation in the S&P 500 as a whole, performance-based awards were also the most commonly granted equity vehicle in each individual sector. A minimum 73.3% of companies offered performance awards regardless of sector. Conversely, the prevalence of time-vesting option awards varied substantially across sectors. Healthcare and utilities represented the high and low ends of the options grant spectrum at 83.3% and 23.1% prevalence respectively.

The differences in equity mix across sectors represent the companies’ solutions to attracting, retaining and incentivizing CEOs given particular industry opportunities and challenges.

Data Points

- The utilities sector had the highest prevalence of both time-based stock and performance-based awards in the S&P 500 in 2015, at 76.9% and 92.3% respectively, and the lowest prevalence of time-based options at 23.1% (Fig. 8)

- The healthcare sector was the only sector where the prevalence of time-based options came within ten percentage points of the prevalence of performance awards—each award type was granted by 83.3% of healthcare companies in 2015 (Fig. 8)

Source: Equilar. Copyright 2016.

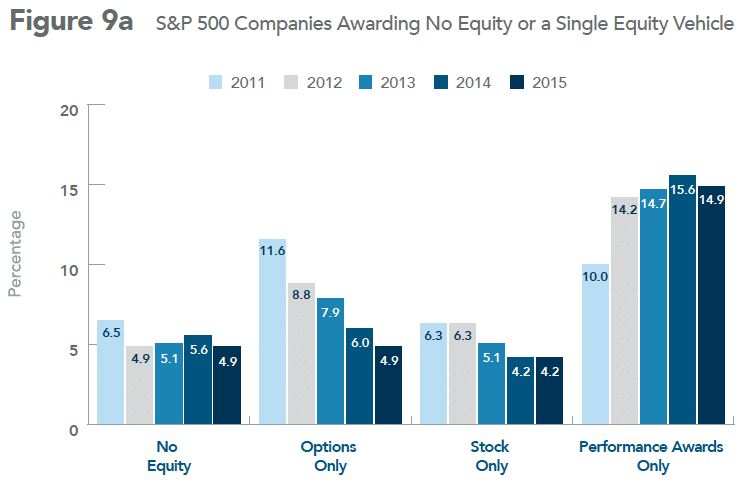

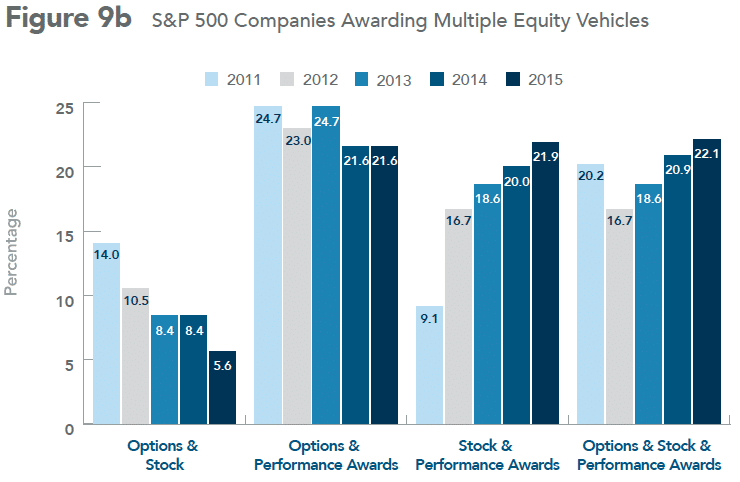

Although the share of companies granting only performance awards has increased since 2011, the use of only a single equity vehicle has gradually declined in prevalence while the use of multiple equity vehicles has increased. In general, the use of performance shares has increased while options have decreased. For the first time over the sample period, grants of all three award types became the most prevalent equity award mix in 2015, with 22.1% of companies awarding time-vesting stock, time-vesting options and performance awards.

Data Points

- The exclusive use of options fell from 11.6% to 4.9% over the past five years (Fig. 9a)

- The use of performance awards alone has largely levelled off after increasing in prevalence by 41.9% from 2011 to 2012 (Fig. 9a)

- The combination of time-vesting stock and performance awards experienced the most growth since 2011, increasing about 140% from 9.1% in 2011 to 21.9% in 2015 (Fig. 9b)

- More S&P 500 companies have used a combination of equity vehicles in each of the last five fiscal years; the percentage of companies awarding multiple equity types increased slightly from 67.9% to 71.2% from 2011-2015 (Fig. 9b)

Source: Equilar. Copyright 2016.

The shift away from stock options and towards stock in the form of performance awards has been steady over the past four years after the mix of performance-based awards vs. time-based awards shifted abruptly between 2011 and 2012. In 2011, the median equity value mix was 68.5% in the form of time-based grants vs. 31.5% in performance-based grants. In 2012, the median value of equity grants at S&P 500 companies was evenly split, and has since remained close, shifting slightly more in favor of performance-based grants from 2012-2015. (Fig. 10)

Source: Equilar. Copyright 2016.

Meridian Compensation Partners Commentary

As the marketplace evolves, additional pay will likely come in the form of variable equity. Many organizations have reviewed the mix of LTI and have established a 50% mix threshold, or more, to be provided in the form of performance shares/units. While there may not have been any one “purpose” or outcome that Say on Pay was intended to achieve, there have been a number of outcomes as a result:

- More companies are engaging with shareholders to explain how compensation plans and programs operate and how pay design aligns with performance

- Companies made concerted efforts to improve their communications with shareholders (i.e. more compelling disclosures in the CD&A)

- Identified or brought to the forefront some of the egregious pay practices at a select few companies

- Forced program design changes, following Say on Pay vote failures

Source: Equilar. Copyright 2016.

Data Points

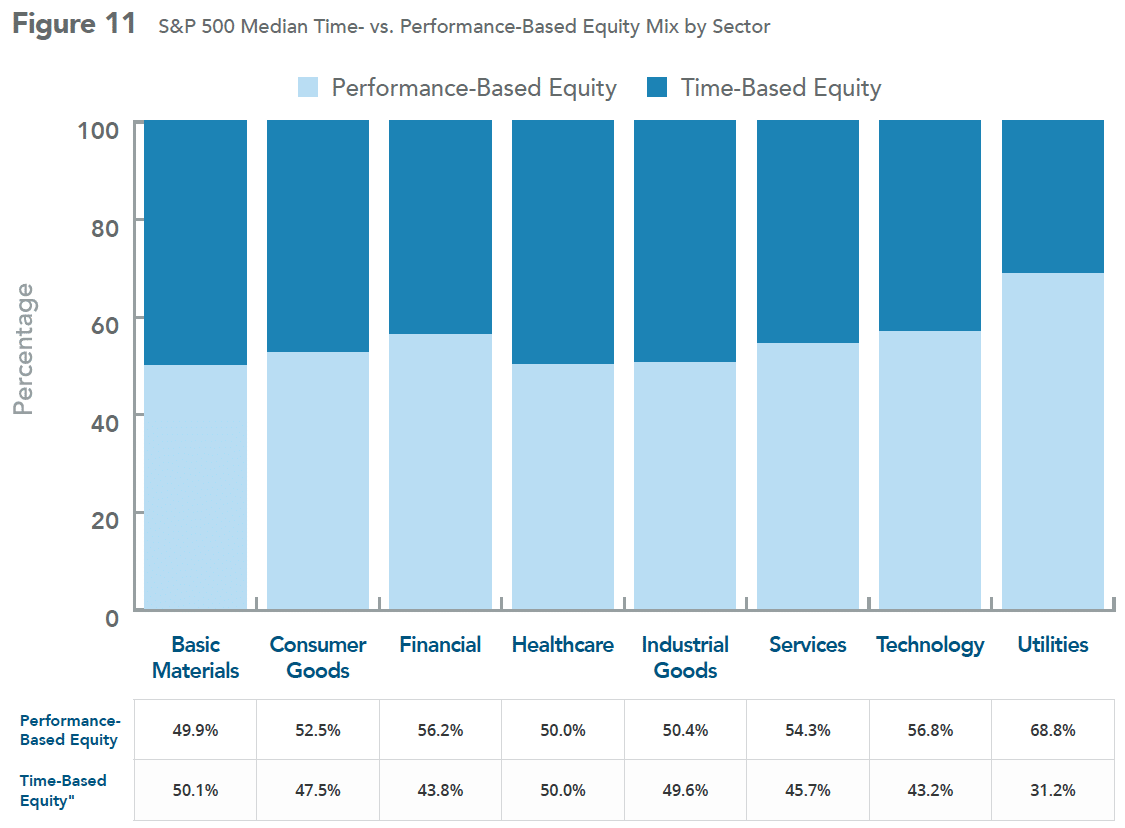

- In 2015, the median company for each sector awarded more value in performance-based awards than time-vesting awards, with the exception of the basic materials and healthcare sectors (Fig. 11)

- The utilities sector had the highest median allocation to performance equity awards, with 68.8% of the value granted in the form of performance awards. (Fig. 11)

* * * * *

This report was produced by Equilar, with commentary from Meridian Compensation Partners. Find more reports from Equilar at Equilar.com.

Key Findings

1. The median reported total compensation for CEOs of S&P 500 companies was $10.4 million in 2015, compared to $8.9 million in 2011. Median reported total compensation increased in each year of the study.

2. Reported base salary and awarded stock grants both increased in median value in each of the past five years, while stock option grants decreased in value at the median over that time period.

3. Equity comprised an average 62.2% of reported CEO compensation for the S&P 500 in 2015, with the balance awarded in cash and value of benefits and perks.

4. More than 80% of S&P 500 companies granted performance-based equity to their CEOs in fiscal 2015, compared to 62.5% in 2011. The percentage of companies offering time-based options decreased during that time from 68.9% to 54.2%.

5. The median equity mix for S&P 500 CEOs shifted from 31.5% performance-based vs. 68.5% time-based in 2011 to 51.6% performance-based vs. 48.4% time-based in 2015.