S&P 500 CEOs’ Reported Compensation: 2021-2024

Posted by Ed Hauder and Frank Carris on December 10, 2024 in Thought Leadership

CEO Compensation generates considerable interest not only from Compensation Committees but also from investors, the press, and politicians. It can be confusing and controversial. This Meridian Insight considers CEO pay among S&P 500 companies and changes in value between 2020 and 2023 based on proxy statements filed in 2021-2024.

Executive Summary

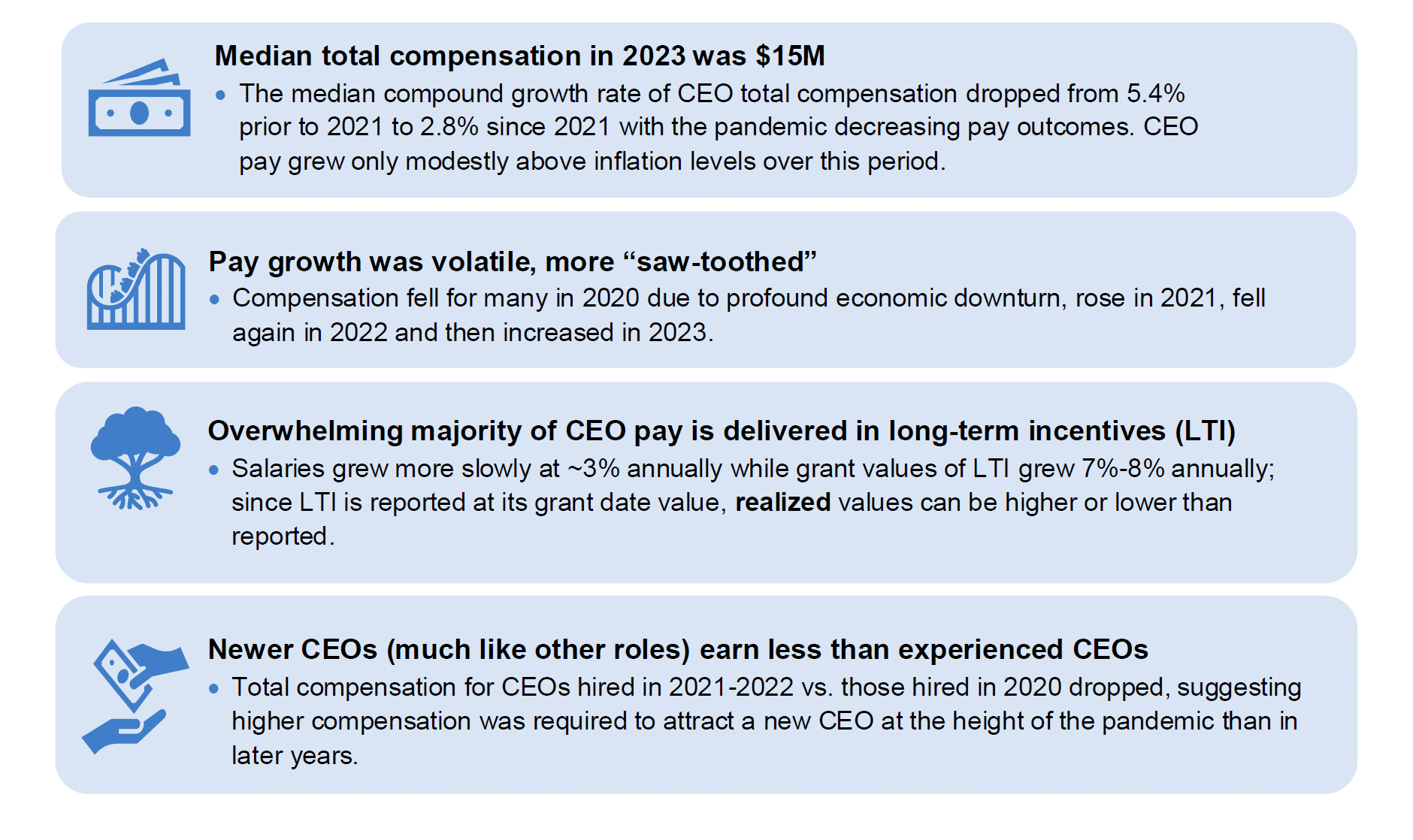

Key Takeaways:

Median Pay of S&P 500 CEOs

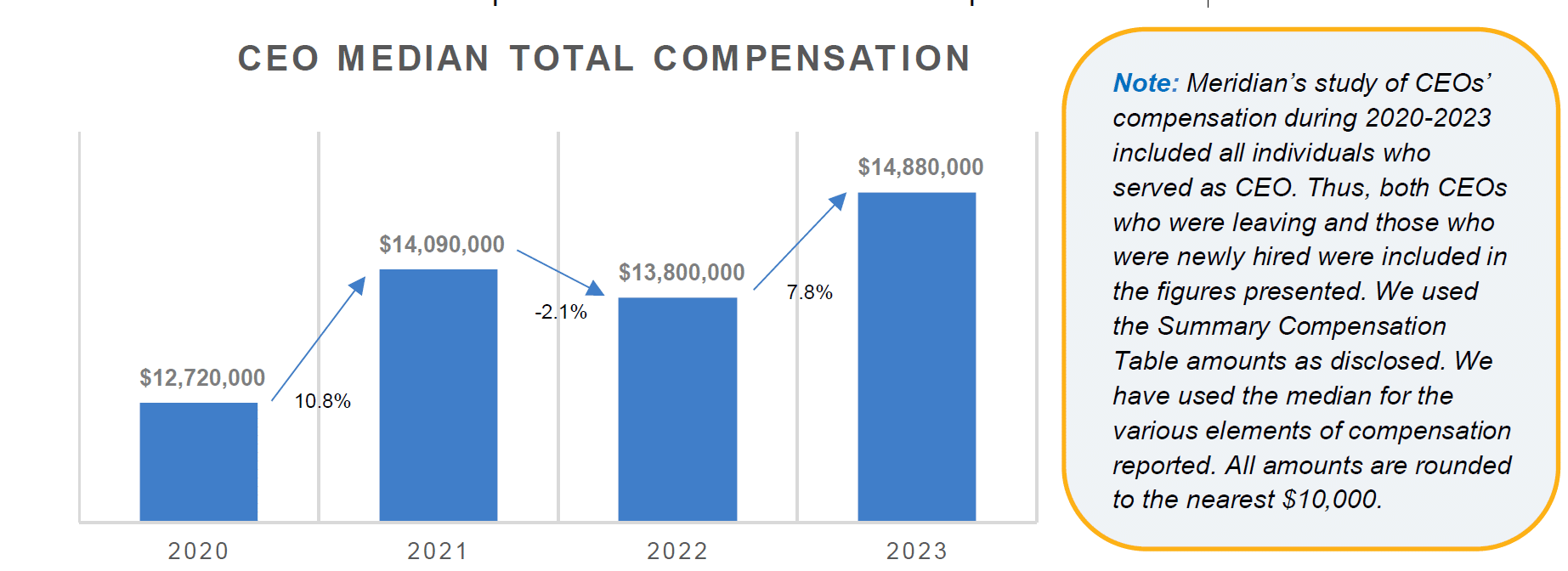

The chart shows median total compensation for S&P 500 CEOs for the period 2020-2023:

Median CEO total compensation for S&P 500 CEOs increased in 2021, reflecting larger LTI grants and higher incentive payouts, possibly because goals for 2021 were set conservatively due to pandemic-driven forces continuing from 2020. Median pay dipped again in 2022 before rebounding in 2023.

In response to the COVID-19 pandemic, many U.S. companies changed their compensation programs, both on a prospective and retroactive basis. Proxy advisors and investors were generally understanding of prospective changes in response to the pandemic but were less willing to accept changes to in-cycle annual awards and were strongly critical of changes to in-cycle long-term incentive awards.

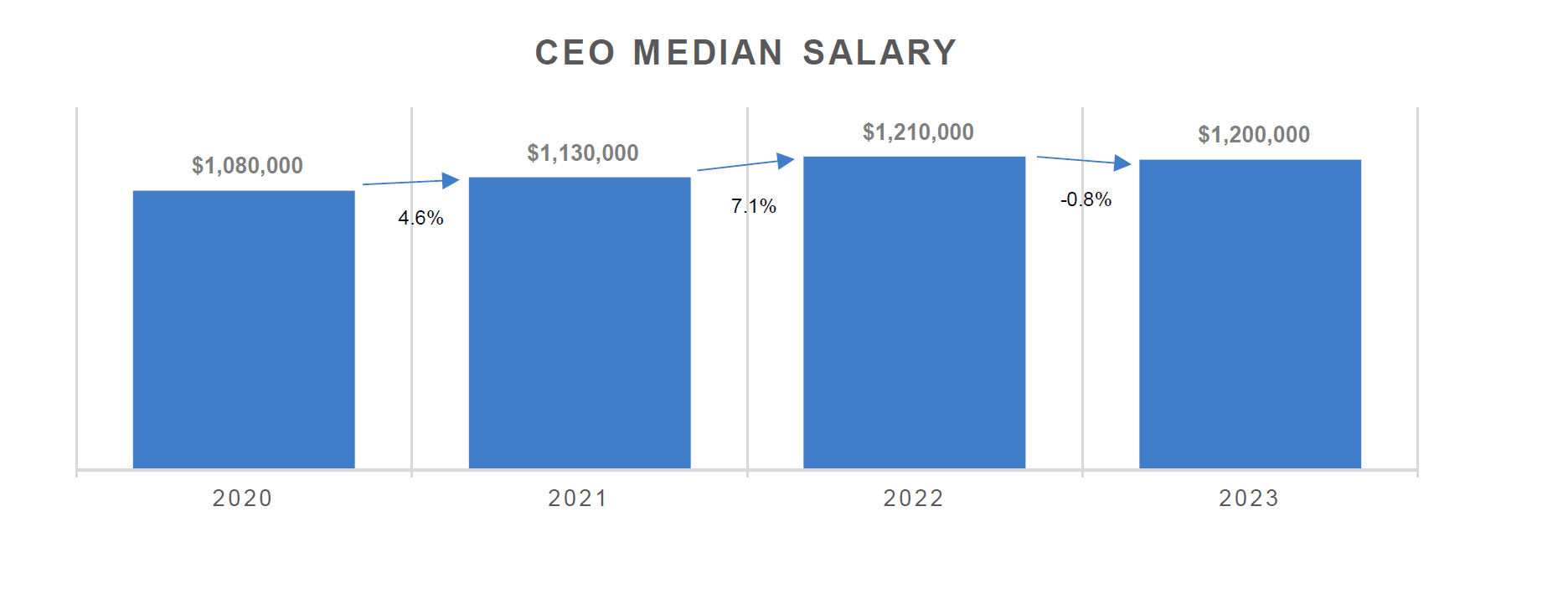

While salaries generally increased each year during the period, the median salary dipped slightly from 2022 to 2023. But, given the change was less than 1%, we view it as being basically flat between 2022 and 2023.

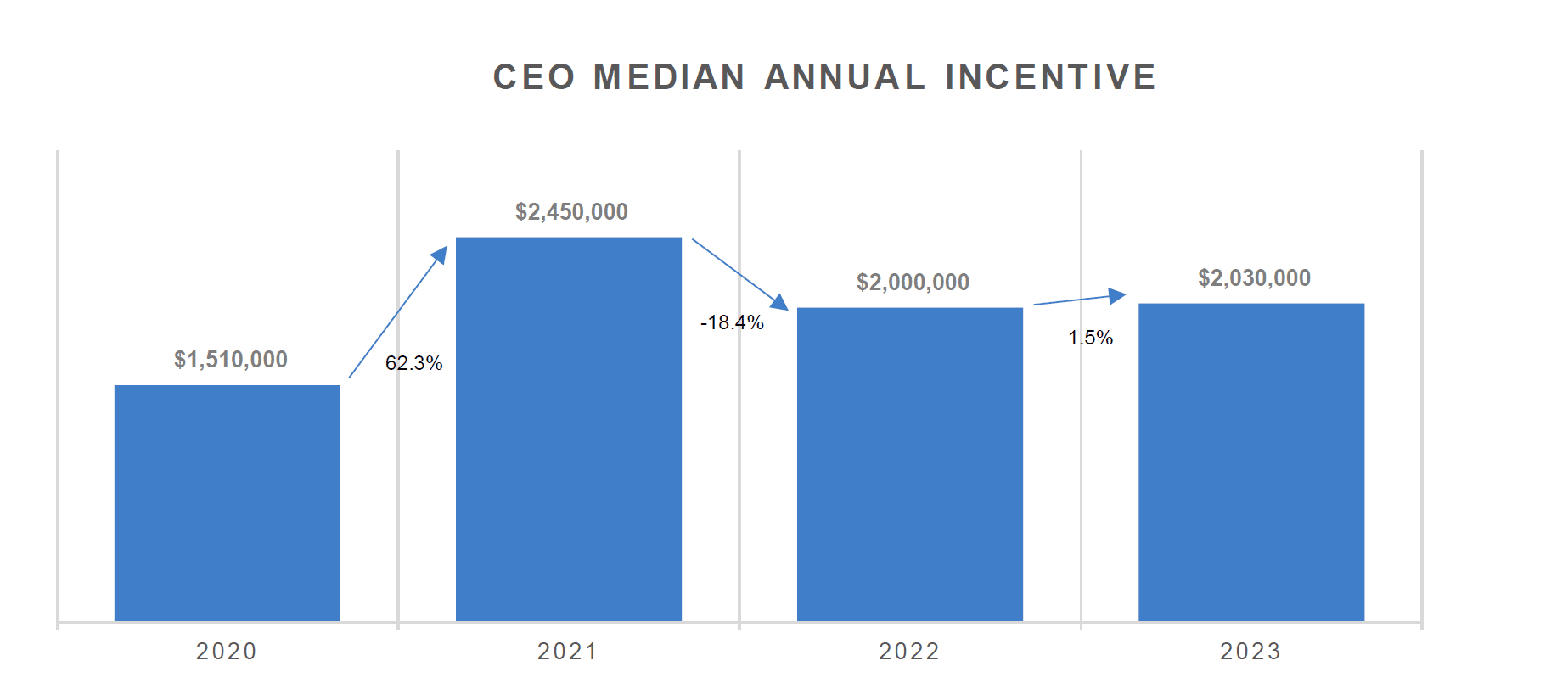

Annual incentives (unlike long term incentives) are reported at their earned value reflecting performance for each year. Median annual incentive increased from 2020 to 2021, likely reflecting challenging business conditions in 2020, the first year of the pandemic. However, the earned annual bonus dropped in 2022 and remained relatively flat through 2023. The decrease from 2021 to 2022 may have been due to companies moving back to more rigorous annual incentive plan goals as economic conditions improved.

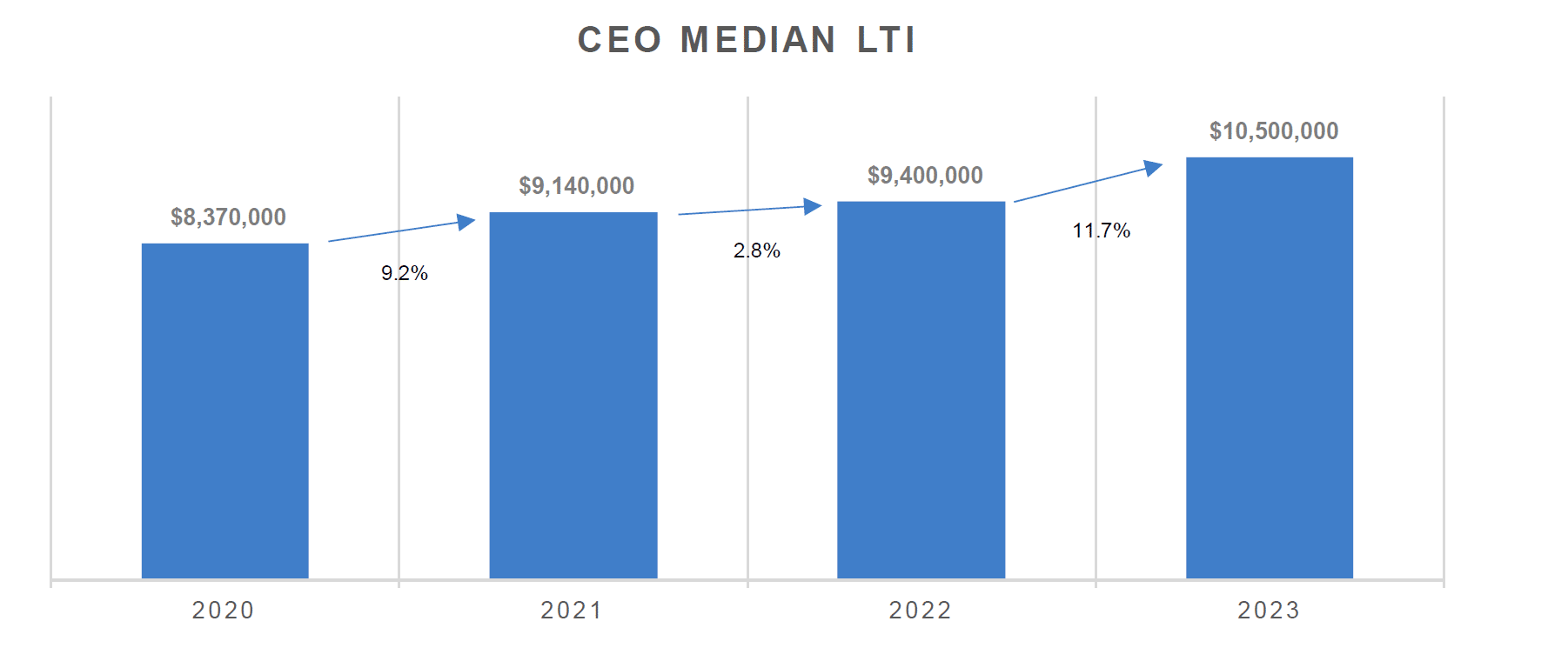

Long term incentive values have increased each year from 2020-2023, consistent with a broader trend to increase the weighting to long-term, at-risk compensation. The larger jump from 2022 to 2023 likely reflects a normalization of the total compensation packages for CEOs post-pandemic to maintain competitiveness and increase CEO alignment with shareholders.

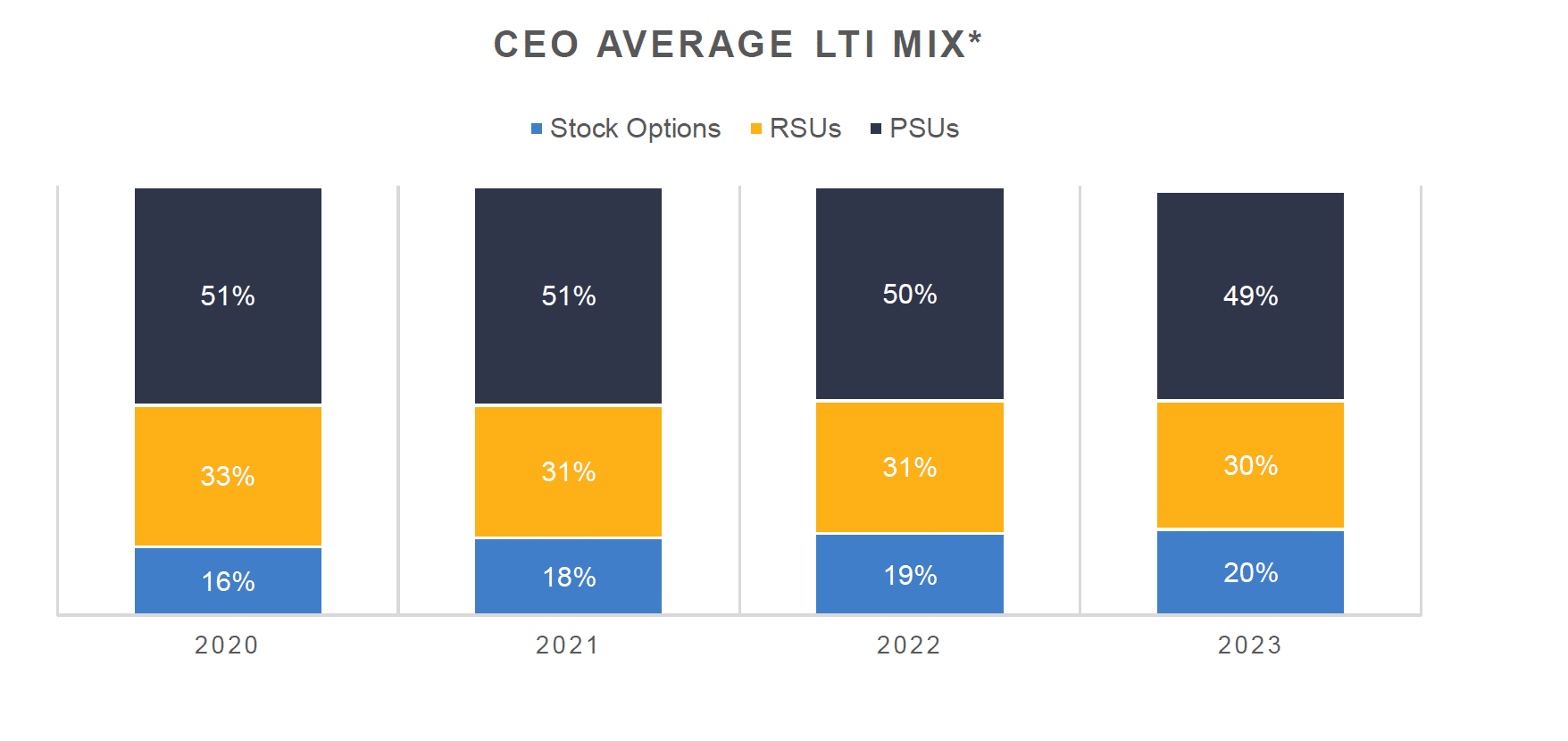

The average mix of LTI has remained largely unchanged for this period and for the last decade or more but varies by industry, individual company outlook and industry-specific macroeconomic conditions.

CEO Transition

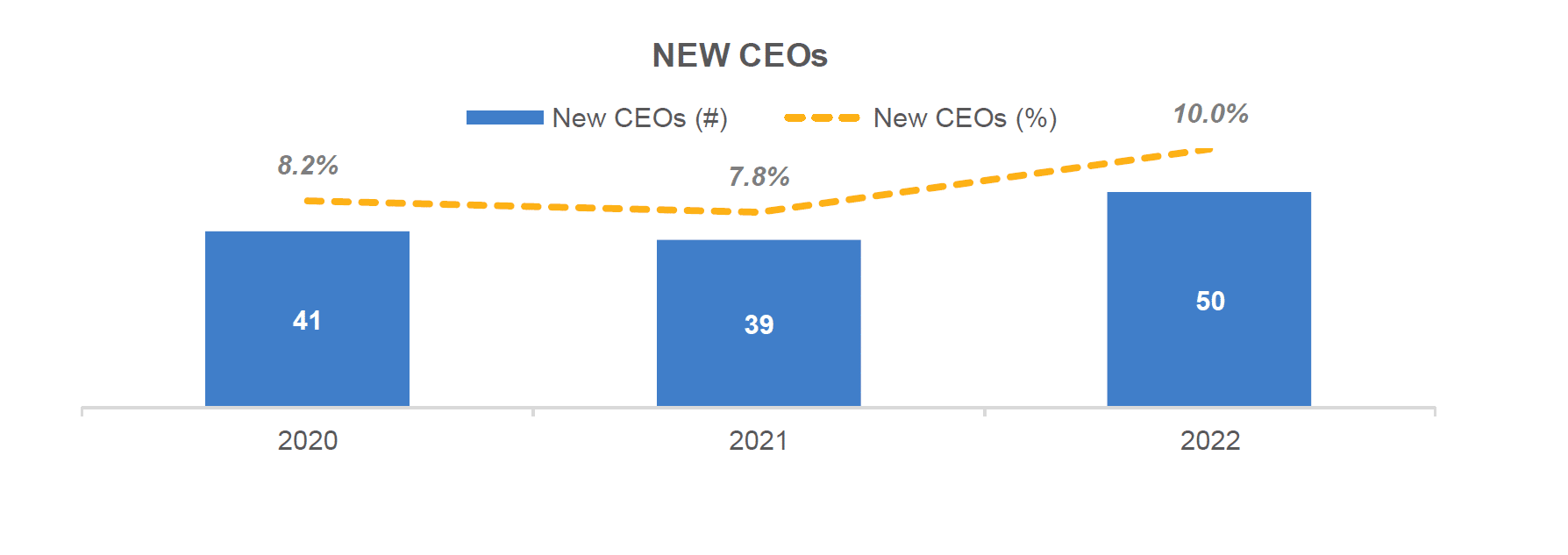

Post-pandemic, the rate of CEO transition increased from ~8% to 10%.

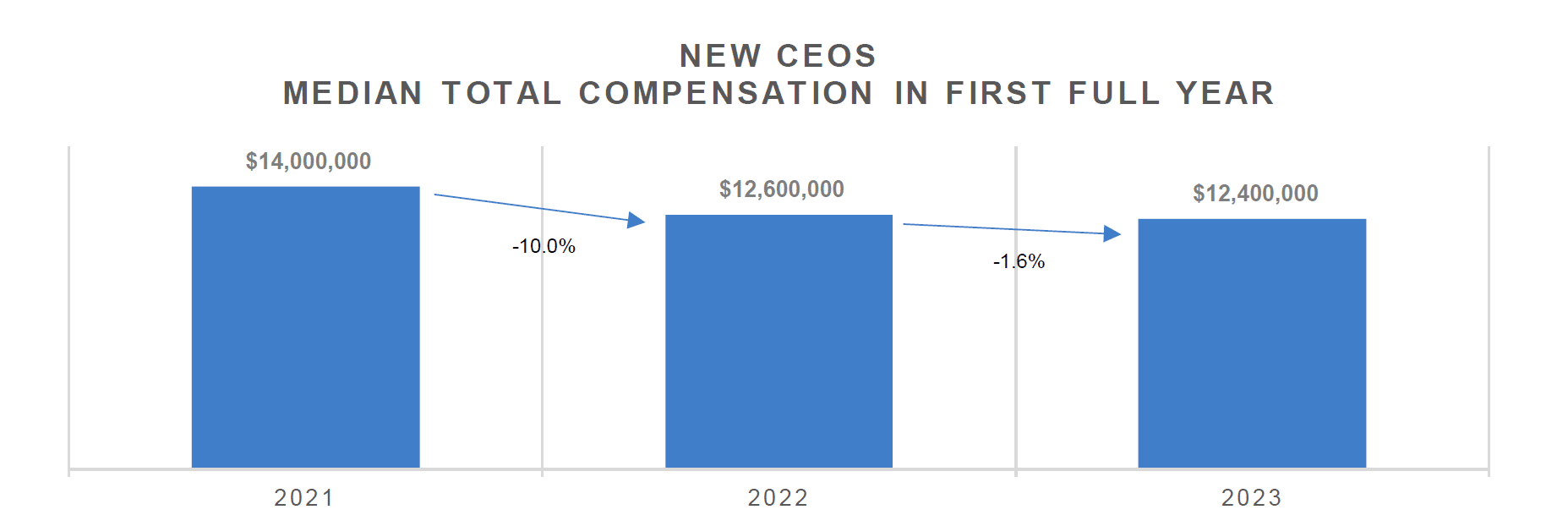

The first full-year’s median total compensation for those CEOs hired in 2021-2022 vs. those hired in 2020 was lower by 10%. This suggests that during the height of the pandemic (2020), it required higher compensation to attract a new CEO than it did post-pandemic.

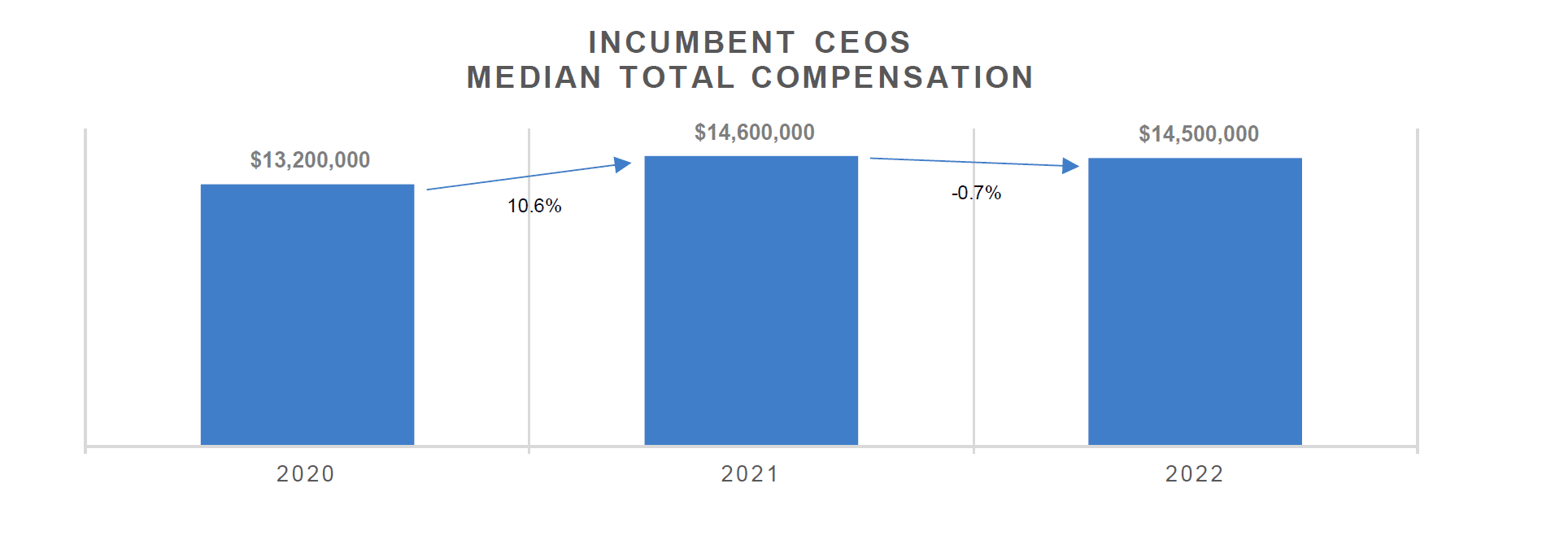

Incumbent CEOs earned above median pay in each year and much more than the new CEOs earned during their first full year of employment. This is consistent with our experience that compensation for newly promoted CEOs tends to ramp up over 2 to 3 years as they become more experienced in the role.

* * * * *

This report is a publication of Meridian Compensation Partners, LLC, provides general information for reference purposes only, and should not be construed as legal or accounting advice or a legal or accounting opinion on any specific fact or circumstances. The information provided herein should be reviewed with appropriate advisors concerning your own situation and issues.

Board Advisory Services, Corporate Governance Consulting, Program Design