Annual incentive plans (AIPs) stand out as crucial drivers in harmonizing the goals of the company, executives, and shareholders. Historically, these plans stuck to a formulaic blueprint — clear goals, defined payment scales and payouts resulting from straightforward mathematical computations. However, the unpredictable nature of the business world, starkly highlighted by the upheavals of 2020, exposed the constraints of such rigid structures. Assumptions once considered solid were quickly overturned, leading to bonuses that no longer reflected actual performance or market realities.

“The volatility of the business landscape necessitates an evolution in AIPs, moving from purely formulaic structures to ones that incorporate elements of discretion and adaptability.”

Recognizing this, Meridian Compensation Partners, LLC has been at the forefront, guiding clients through a paradigm shift in their approach to AIPs. As we navigate through 2023, an increasing number of companies are embracing the concept of integrating discretionary elements into their compensation plans. This notion of ‘discretion’ allows a compensation committee to determine a portion of the payout based on subjective assessments, harmoniously blending with traditional incentive markers like financial achievements.

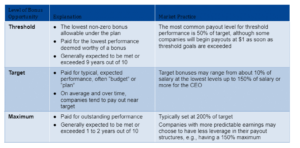

Bonus opportunities are generally expressed as a percent of base salary and payout opportunities are set at three levels: Threshold, Target, and Maximum.

More than just financial rewards, well-structured AIPs are the linchpins that motivate performance and align personal successes with broader business goals and strategies.

This in-depth guide explains AIPs, shedding light on their key elements, the delicate equilibrium between short-term achievements and sustained long-term performance, and the emerging trends redefining incentive compensation structures. Join us as we unravel the intricacies, current trends and best practices of AIPs, laying out your organization’s path to unparalleled success.

Understanding Annual Incentive Plans

In executive compensation, clarity, precision and strategic alignment form the bedrock of effective incentive programs. To comprehend the value and functionality of AIPs, we must first define them and understand their unique role in an organization’s broader compensation strategy.

What Are Annual Incentive Plans?

At their core, AIPs are performance-based compensation programs designed to reward employees for meeting or exceeding specific short-term performance targets within a one-year period. These plans are typically monetary but can also include non-cash rewards. The defining characteristic of AIPs is their focus on short-term objectives, serving as a motivational tool that encourages individuals and teams to align their efforts with the company’s immediate strategic goals.

The Strategic Imperative of Annual Incentive Plans

A well-designed AIP serves multiple critical purposes. First, an AIP acts as a magnetic force for attracting top-tier talent. In a marketplace where skill and expertise are premium commodities, AIPs offer a competitive edge in recruitment, presenting a clear financial incentive that potential employees find attractive.

Second, an AIP is invaluable for talent retention. By offering financial rewards contingent on short-term performance, employees are encouraged not only to meet targets but to exceed them, fostering a culture of high performance and continuous improvement. This dynamic, in turn, cultivates loyalty as employees appreciate the direct correlation between their efforts and financial rewards.

Third, an AIP is a potent motivator. They reinforce a performance-oriented culture, creating a workplace environment where achievement is recognized and rewarded. This not only boosts individual morale but also fosters a collective drive towards organizational success.

“AIPs are more than just short-term compensation. They are strategic levers that attract, motivate and retain high-caliber talent, binding individual success to the organization’s triumphs.”

Distinguishing AIPs From Other Incentive Compensation

While AIPs focus on short-term goals, other forms of incentive compensation, such as long-term incentives (LTIs), address multi-year performance and often come in various forms like stock options, restricted stock or performance shares. The key distinction lies in the timeframe and the nature of the goals set. AIPs incentivize annual performance, typically based on financial, operational or individual metrics relevant to the fiscal year, whereas LTIs are designed to ensure that executives and key employees have a sustained stake in the company’s long-term success and shareholder value creation.

Furthermore, unlike base salaries that compensate employees for their role, AIPs provide rewards for achieving or surpassing short-term expectations, encouraging employees to perform beyond the standard requirements.

Best Practices in Designing Annual Incentive Plans

Creating robust AIPs is no small feat. It requires a strategic blend of business acumen, understanding of human behavior and foresight. Below, we delve into the best practices that ensure your AIP is not just another document, but a driving force propelling your organization toward its strategic goals.

1. Aligning With Corporate Strategy

The effectiveness of an AIP is significantly diminished if it exists in a vacuum. These plans need to be meticulously aligned with the company’s broader corporate strategy. Whether the focus is on expansion, consolidation, innovation, customer satisfaction or operational efficiency, the AIP should reflect these objectives through its performance metrics. This alignment helps ensure that every bit of individual effort directly contributes to the overarching corporate goals.

“The power of an AIP is fully harnessed when individual achievements ripple upwards to propel corporate strategy forward.”

2. Balancing Metrics

Organizations often use two to four key performance indicators in their annual incentive programs, primarily financial metrics but also quantifiable business goals. As one ascends the corporate ladder, the emphasis on individual performance diminishes, with broader organizational goals taking precedence.

Performance metrics are clear-cut targets. Comparing with peer performance is rare for annual bonuses due to three reasons:

• They’re unique motivators for optimal annual performance.

• Quick bonus disbursement can make peer data collection challenging.

• Multi-year relative performance comparisons are more meaningful.

Many firms balance return metrics (ROE, ROIC), with growth metrics, such as EPS (Operating Income, EPS). While formulas often dictate bonus plans, there’s a trend towards adding discretion in payout determination, reflecting modern business complexities.

A common pitfall in designing AIPs is over-reliance on either financial metrics or operational indicators. The most impactful AIPs maintain a healthy balance between the two, often complemented by individual performance measures. Financial metrics, while critical, focus on the end result. Operational metrics, on the other hand, shed light on the performance drivers, the aspects employees directly influence. Individual performance measures further personalize the AIP, tying personal achievements and growth to the company’s success. This balanced scorecard approach ensures a holistic view, discouraging siloed efforts and encouraging behaviors that contribute to overall success.

3. Setting Clear, Achievable Goals

The objectives outlined in an AIP must be challenging, yet attainable. Impossibly high targets can demoralize employees, while low bars won’t push them beyond their comfort zones. Utilizing the SMART (specific, measurable, achievable, relevant, time-bound) framework can provide clarity and direction. Moreover, goals should be flexible enough to allow for adjustments in response to significant business changes or unforeseen market conditions.

4. Communication and Transparency

An AIP, no matter how well-designed, will falter if it’s not effectively communicated. Employees need to understand the plan’s mechanics, the performance metrics and, most crucially, the ‘why’ behind their goals. This communication must be clear, consistent and ongoing, creating a two-way dialogue that allows for feedback and clarification. Additionally, transparency in the process reassures employees of the fairness of their evaluation, fostering trust in the system.

5. Regular Monitoring and Feedback

AIPs are not ‘set-and-forget’ instruments. Regular monitoring is essential to assess the plan’s effectiveness and the progress individuals are making towards their goals. Leaders should provide continuous feedback, both positive and constructive, to guide their teams. This practice not only keeps employees focused and informed but also allows for mid-course corrections if certain aspects of the plan are not working as intended.

6. Discretionary Considerations

While the AIP should predominantly be based on measurable metrics, incorporating a discretionary component gives management the leeway to reward exceptional non-quantifiable achievements. Such considerations must be approached judiciously, with clear guidelines to ensure fairness and avoid perceptions of favoritism.

7. Legal Compliance and Documentation

Compliance with legal standards and proper documentation are paramount. Every aspect of the AIP, including the process of goal-setting, evaluation and reward allocation, must adhere to applicable laws and regulations. Thorough documentation helps in maintaining a clear record for audits and demonstrates the organization’s commitment to lawful and ethical practices.

Current Trends and Best Practices in Annual Incentive Plans

For compensation committees, staying abreast of current trends is not just beneficial; it’s imperative. AIPs are dynamic tools and their structure and implementation must pivot and adapt in response to the shifting paradigms of the business world. Here, we outline the most salient trends and best practices in AIPs that forward-thinking companies like yours are adopting.

1. Payout Curves

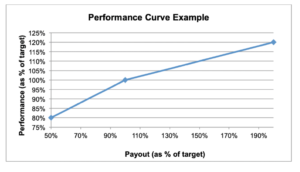

A threshold, target, and maximum performance versus payout relationship must be established in an annual incentive plan. While each company’s scenario and measurements vary greatly, a common threshold performance level would be 80%-90% of target performance, and a common maximum performance level would be 110%-120% of target performance.

The illustration below serves as an example. Curves may differ within the business cycle and even within industries, depending on how simple it is to define performance goals. In circumstances where goal setting is particularly challenging due to economic uncertainty or other concerns, for example, a Committee may choose to construct a substantially flatter slope with less fluctuation in reward for any given improvement in performance.

2. Greater Emphasis on Non-Financial Metrics

Today’s AIPs increasingly recognize the value of non-financial metrics. While revenue, EBITDA and other financial markers are critical, metrics related to customer satisfaction, employee engagement, sustainability and corporate social responsibility are gaining prominence. This shift reflects the understanding that long-term success is built on a foundation of more than just financial performance.

“Incorporating non-financial metrics in AIPs acknowledges the multifaceted nature of organizational success.”

3. Increased Use of Discretion

The volatile business environment, especially noticeable post-2020, has underscored the limitations of strictly formulaic AIPs. In response, there’s a marked trend towards incorporating discretionary elements into these plans. This approach allows compensation committees to consider broader contextual factors and make adjustments, ensuring that payouts accurately reflect individual and company performance in light of prevailing circumstances.

4. Focus on Diversity, Equity and Inclusion

DEI goals are increasingly being integrated into AIPs, a trend driven by both societal shifts and the recognition of the tangible benefits of a diverse workforce. Companies are setting specific DEI objectives, such as increasing representation in leadership roles and enhancing pay equity, and are tying these goals to executive compensation.

5. Agility in Goal-Setting

The business landscape is more dynamic than ever, necessitating agility in goal-setting. Progressive companies are incorporating mechanisms to adjust goals within the performance cycle. This flexibility ensures that AIPs remain relevant and motivational, even amidst unforeseen changes.

6. Transparency and Communication

With growing scrutiny from shareholders and proxy advisors, companies are enhancing transparency around AIPs. Clear, comprehensive communication about the plan’s structure, performance metrics and payout rationales is becoming standard practice. This trend is not just about compliance; it’s about building trust with employees, investors and stakeholders.

7. Technology Integration

From data analytics to AI, technology is playing a bigger role in AIPs. Companies are leveraging tech tools to track performance metrics in real-time, provide predictive insights and ensure more objective and data-driven decision-making. This integration is streamlining AIP administration and enhancing the accuracy and relevance of performance assessments.

Final Thoughts

This guide highlights AIPs as key drivers of organizational success, crucial for attracting and retaining top talent who propel innovation and growth.

Even well-executed AIPs’ effectiveness requires regular review and adjustment in response to changing business landscapes. Aligning an AIP with industry standards and providing the appropriate motivation to employees is a continuous endeavor.

Beyond mere alignment, forward-thinking organizations anticipate changes, ensuring their compensation strategies remain robust and in sync with emerging trends and market shifts, thereby embracing a proactive stance towards AIP optimization.

The Meridian Difference in Annual Incentive Plan Development

Meridian Compensation Partners, LLC sets the gold standard in developing AIPs that drive organizational success. Our journey with each client begins by deeply understanding their unique business objectives, which informs our development of an AIP for the client that is not generic, but finely tuned to that company’s specific needs.

Our expertise extends beyond creating plans to ensuring they’re executed within a framework that balances motivation with achievable outcomes. The approach of Meridian Compensation Partners, LLC ensures that AIPs are not merely short-term motivators but instruments of sustainable growth, aligning individual achievements with the company’s long-term goals, objectives, and strategy, as well as shareholder expectations.

What truly sets us apart is our proven track record. We’re not just theorists; our strategies are backed by successful real-world applications, reflected in the testimonials of satisfied C-suite executives and board members. Our clients have experienced first-hand how our innovative practices transform the theoretical promise of AIPs into tangible business successes.