Christina Medland

Christina Medland

The government has proposed to limit the preferred tax treatment for stock options. Currently options are eligible for a deduction the effect of which is to tax them at one-half the ordinary income tax rate (similar to capital gains treatment).

There are two proposed exemptions to this change:

1. The proposed rule will only affect employees of “large, long-established, mature firms”. The Budget does not define these companies but has indicated that start-ups and “rapidly growing businesses” will be exempt.

2. $200,000 of options granted each year will remain eligible for preferred tax treatment at the time they are exercised. Although not clearly addressed, the examples provided in the Budget suggest that:

− The $200,000 will be determined based on the “face value” of the shares underlying the options, rather than the value used for securities disclosure purposes, which is typically a Black-Scholes or binomial value.

− The exemption will be determined on the basis of the fair market value of the shares underlying options at the time of the award, rather than being based on in-the-money value realized on exercise of the options. This will likely require filings when options are awarded which will allocate option awards between those qualified for preferred tax treatment and non-qualified options.

Correspondingly, a corporate tax deduction will be available for the portion of the option award not eligible for preferred tax treatment, similar to the corporate deduction for non-qualified stock options in the United States.

Further details of the plan are due in the summer. The Budget indicates that these changes will apply to future grants of stock options only, and would not apply to employee stock options granted prior to the announcement of legislative proposals to implement any new regime.

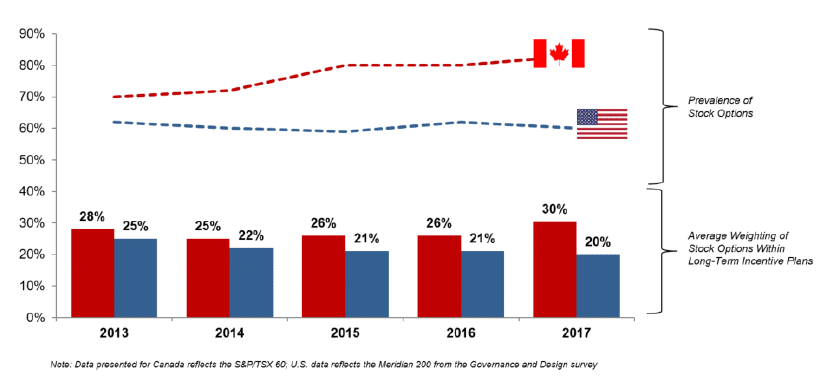

Stock Option Prevalence and Weight in LTI Plans Among Large North American Companies

Based on public filings from 2018 and earlier, stock option usage among large Canadian companies has plateaued in Canada (with ~80% of the TSX 60 granting options to executives in the 2017 compensation year). In the U.S., there has been a decline in stock option usage, at around ~60% prevalence for the Meridian 200 (a sample of large U.S. public companies).

Meridian Comment: The federal government’s move to limit the preferred tax treatment of stock options aligns with tax treatment in the United States (where income realized upon the exercise of most stock options is taxed at ordinary income tax rates, not capital gains tax rates).

We expect that, in light of the proposed legislation, companies subject to the cap will take a fresh look at their long-term incentive design and vehicle mix. Option usage may decline, long-term incentive compensation levels may increase and the practice of making large, multi-year option awards is likely to significantly decrease.

In order to fill the gap left by a reduction in options, more companies may consider treasury-settled share unit plans, in order to provide a longer term, tax deferred form of equity incentive.

* * * * *

The Client Update is prepared by Meridian Compensation Partners. Questions regarding this Client Update or executive compensation technical issues may be directed to:

Christina Medland at (416) 646-0195, or cmedland@meridiancp.com

Andrew McElheran at (416) 646-5307, or amcelheran@meridiancp.com

Andrew Stancel at (647) 478-3052, or astancel@meridiancp.com

Andrew Conradi at (416) 646-5308, or aconradi@meridiancp.com

Matt Seto at (416) 646-5310, or mseto@meridiancp.com

This report is a publication of Meridian Compensation Partners Inc. It provides general information for reference purposes only and should not be construed as legal or accounting advice or a legal or accounting opinion on any specific fact or circumstances. The information provided herein should be reviewed with appropriate advisors concerning your own situation and issues.

www.meridiancp.com