Christina Medland

Christina Medland

Introduction

ESG metrics are in transition, with different countries, industries and companies at different places. Increasingly, the approach to ESG incentive plan metrics is driven by the importance of ESG to business strategy and metrics are closely aligned with what matters to shareholders, customers and business performance.

This update provides ten keys to managing this shifting landscape.

1. Understand the Importance of ESG in your Industry

Decisions relating to ESG incentive metrics start with an understanding of the importance of ESG to your industry. If ESG is a competitive advantage (e.g. businesses with a sustainability purpose, such as electric car manufacturers) or necessary for long term success in the industry (e.g. an oil E&P company), it is more likely to be an important incentive component.

Prevalence of ESG Metrics by Industry

Source: Meridian’s ESG Incentive Practices at S&P 500 Companies (June 2024).

2. Ensure that ESG Metrics are Aligned with your Business Strategy

Effective incentive design should start with the company’s business strategy and focus on the metrics that drive performance and create shareholder value in both the short and long-term. This principle applies to ESG metrics just as much as to financial and operational metrics, but the direct connection between business strategy and business performance (on the one hand) and ESG metrics (on the other hand) can be more difficult to assess. ESG “check the boxes” metrics that are not critical to the business are not effective to support the right performance and are vulnerable to investor criticism.

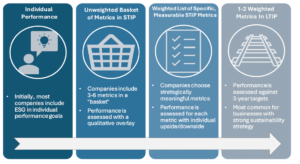

3. Consider Where Your Company is on the Sustainability Fairway

Most companies are in one of the baskets below, depending on:

• The importance of ESG to the business and industry.

• The company’s experience with measuring ESG.

It is important to align your ESG metrics to where your company actually is and to assess this positioning periodically, particularly with changes in strategy or industry practices.

4. Choose the Right Plan

The annual and long-term plans have somewhat different underlying purposes. We typically think of the annual incentive plan as supporting the behaviors required to achieve near term goals and the long-term plan as focusing on alignment with long-term shareholder value creation.

It can be challenging to fit ESG metrics into this construct because ESG metrics may have a mix of features, some of which are better suited to:

• Annual plan—the need to drive behavior and challenges setting goals

• Long-term plan—it may take several years to make meaningful progress, while avoiding short term fixes and unintended consequences

Prevalence of ESG in Annual (AIP) and Long-Term Incentive Plans (LTIP)

Source: Meridian’s ESG Incentive Practices at S&P 500 Companies (June 2024).

5. Think About Incentive Leverage

One of the challenges with ESG metrics is managing leverage: i.e., upside (maximum) and downside (threshold) performance levels. It can be difficult enough to set a target performance level on these metrics. For milestone-based metrics, there may not be a reasonable threshold and maximum performance construct. In these cases, we see companies adopting some of the following strategies:

• Where ESG metrics are part of a basket and not individually weighted, the compensation committee can assess performance qualitatively, looking at results achieved and the importance of the results to the business to determine the performance level, including above and below target performance.

• ESG metrics can be individually scored on a binary (achieved or not achieved) basis, with upside or downside based on the number of metrics achieved (a fairly blunt instrument).

• ESG metrics can be scored on a binary basis, with upside (but typically not downside) aligned with the overall corporate performance payout factor, to avoid reducing the overall upside leverage in the plan.

6. Watch Out for Unintended Consequences

Like safety, turnover and employee engagement metrics, other ESG metrics can lead to the wrong behaviors or to unintended consequences, such as:

• Underreporting of environmental issues.

• Hiring or the perception that hiring of diverse candidates is based on diversity, rather than qualification.

• Actions being taken to achieve short-term improvements in greenhouse gas emissions, without making long-term investments and actually making it harder to achieve net zero in the longer term.

The design of the metric and performance targets should anticipate and moderate for unintended consequences and the compensation committee should retain discretion to adjust for results achieved at the expense of the business. Targets should similarly be set realistically, e.g. setting a long-term emissions reduction goal that accounts for the expected “hockey stick” improvement curve for emissions reductions (i.e., not linear).

7. Align with External Commitments

When trying to decide on ESG metrics, one of the best places to look is at the company’s external commitments made in:

• Investor presentation materials

• Debt covenants, particularly sustainability or “green” financing

• Externally released strategy materials

• Employee and stakeholder communications

As these metrics are already considered important to investors, lenders, the market or employees.

8. Take a Look at your Peers

Another place to find examples of ESG metrics is by looking to the company’s closest business competitors. This group of competitors should be companies that are at a similar point in their ESG journey and which are trying to solve similar sustainability challenges.

9. Consider Outsourcing

Given the current challenges of measuring ESG based metrics, some companies delegate the measurement of ESG performance to third parties. These metrics will be tied to a score provided by a third-party provider, and has the following advantages:

• Easy to set targets.

• Typically measures relative performance.

However, the downside is that the company has no control over (or even line of sight to) the measurement process and it is not necessarily aligned with the company’s strategy. This may make third party measures important to track, but less attractive from an incentive perspective.

10. Ensure Metrics Align with what Matters to Shareholders

The best ESG metrics should make sense to your shareholders because they are important to your industry, aligned with your strategy and support the long-term value of the business. This requires strong alignment of metrics with strategy and the long-term goals of the company.

For a more detailed market perspective on ESG metrics, see Meridian’s ESG survey.

* * * * *

This Client Update is prepared by Meridian Compensation Partners, LLC, provides general information for reference purposes only, and should not be construed as legal or accounting advice or a legal or accounting opinion on any specific fact or circumstances. The information provided herein should be reviewed with appropriate advisors concerning your own situation and issues. www.meridiancp.com

Questions regarding this Client Update or executive compensation technical issues may be directed to:

Christina Medland at (416) 566-1919 or cmedland@meridiancp.com

Andrew McElheran at (647) 472-7955 or amcelheran@meridiancp.com

Andrew Stancel at (647) 382-7684 or astancel@meridiancp.com

Matt Seto at (647) 472-0795 or mseto@meridiancp.com

Andrew Conradi at (647) 472-5231 or aconradi@meridiancp.com

Rachael Lee at (647) 975-8887 or rlee@meridiancp.com

Kaylie Folias at (416) 891-8951 or kfolias@meridiancp.com

Jason Chi at (647) 248-1029 or jchi@meridiancp.com

Gabrielle Milette at (905) 242-0503 or gmilette@meridiancp.com

Wali Ahmed at (647) 208-0132 or wahmed@meridiancp.com

Steve Li at (437) 451-2710 or sli@meridiancp.com

Bill Shi at (437) 872-1825 or bshi@meridiancp.com

Krunal Billimoria at (647) 267-5869 or kbillimoria@meridiancp.com