Donald Kalfen

Donald Kalfen

To protect the confidential and proprietary information included in this material, it may not be disclosed or provided to any third parties without the approval of Meridian Compensation Partners, LLC © 2021 Meridian Compensation Partners, LLC.

Contents

Introduction

• Report Scope and Study Group Characteristics

• Overview of Executive Severance Arrangements

• Key Findings

Executive Severance Benefits

• Executive Severance Arrangements

• Payment Triggers for Cash Severance Benefits

• Cash Severance Benefits

• Stub-Year Bonus

• Continuation of Health Care Benefits

• Treatment of Long-Term Incentive Awards

Appendix – List of S&P 500® Companies in Study Group

Meridian Compensation Partners Profile

Report Scope and Study Characteristics

Meridian’s 2021 Study of Executive Severance Arrangements Not Related to a Change in Control (“Study”) provides current information and data on severance practices, not in the context of a change in control, at 100 large U.S. public companies (“Study Group”). Each of the 100 companies in the Study (“Study Group”) was a component company of the Standard & Poor’s 500® Index¹ (“S&P 500®”) as of December 31, 2020.

Development of Study Group Statistics

We derived data and information for the Study primarily from Main Data Group and our separate review of annual shareholder proxies filed with the Securities and Exchange Commission by Study Group companies. Throughout this Study, we reference data according to the fiscal year covered by the proxy statement, not according to the year in which the proxy statement was filed with the SEC.

Generally, the Study shows prevalence statistics for the chief executive officer (“CEO”) and average prevalence statistics for the other NEOs.

Study Group Characteristics

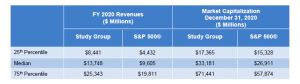

The Study Group companies cover each major industrial sector of the S&P 500®. The median revenues and market capitalization of the Study Group and S&P 500® are compared in the table below.

Report Scope

The Study provides prevalence data on the following aspects of executive severance arrangements that cover named executive officers² (“NEOs”): (i) payment triggers, (ii) cash severance benefits, (iii) stub year annual bonus, (iv) continuation of health care benefits and (v) treatment of long-term incentive awards. However, the Study does not take into account benefits that may be payable to an NEO upon death, disability or retirement, or capture potential enhancements that may be negotiated upon actual termination.

Overview of Executive Severance Arrangements

Executive severance arrangements refer to any arrangement that provides benefits to an NEO upon a qualifying termination of employment that is not related to or contingent upon a change in control of the enterprise.

Rationale for Executive Severance Arrangements

There are important business rationales for maintaining executive severance arrangements, which include the following:

• Attracting executives by providing an appropriate level of financial protection against involuntary job loss,

• Providing a competitive component of compensation,

• Retaining executives through turbulent times, and

• Securing restrictive covenants such as non-compete, non-solicitation, etc.

Forms of General Severance Arrangements

Executive severance arrangements typically take the form of either: (i) an executive severance plan or policy covering executives by name or by group (the current trend), or (ii) an individual employment contract or severance agreement. Executives also may be eligible to receive severance benefits solely under a broad- based severance plan. Separately, a company’s equity incentive plan or applicable award agreements may provide special treatment of outstanding equity awards upon certain termination of employment events.

Trigger for Executive Severance Benefits

Executive severance benefits are universally triggered upon an executive’s termination of employment without “cause.” Less frequently, executive severance benefits are triggered upon an NEO’s voluntary termination of employment for “good reason.” The lower prevalence is primarily due to company preference to retain flexibility to modify compensation and benefit arrangements, reporting relationships, duties and/or office location over time, without triggering executive severance benefits.

Types of Executive Severance Benefits

The Study covers the two most common types of severance benefits – cash severance and vesting of long-term incentive compensation. Other severance benefits that are often provided to executives include:

• Current year bonus,

• Continuation of health care benefits, and

• Outplacement services.

Restricted Covenants and Release and Waivers of Claims

Often, the payment of severance benefits is conditioned upon an executive’s adherence to restrictive covenants and/or execution of a comprehensive release and waiver of claims. Restrictive covenants may include non-compete, non-solicitation, non-disclosure and non-disparagement provisions. Releases and waivers typically prohibit a departing executive from bringing a lawsuit against the former employer for employment-related causes of actions, including actions under the Age Discrimination in Employment Act.

Key Findings

Executive Severance Arrangements

69% of Study Group Companies provided Cash Severance to at least one named executive officer.

Payment Triggers for Cash Severence Benefits

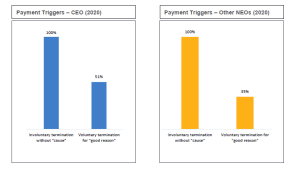

The payment of cash severance is always triggered upon an involuntary termination without “cause” and to a significantly lesser extent upon a voluntary termination for “good reason.”

Cash Severance Benefits

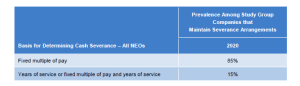

85% of companies determined the amount of cash severance based on a fixed multiple of “pay”.

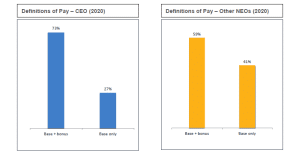

• Definition of Pay – The majority practice is to define pay as the sum of base salary and bonus (with bonus typically defined as current year target bonus).

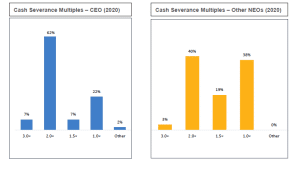

• Cash Severance Based on a Fixed Multiple of Pay – The dominant severance multiple for CEOs and other NEOs was 2.0x (62% and 40% of companies, respectively).

Stub-Year Bonus

61% of companies that maintained executive severance arrangements paid stub-year bonuses on a pro rata basis (typically based on target).

Continuation of Health Care Benefits

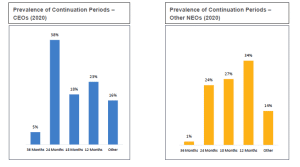

The most prevalent continuation periods were 24 months (38%) and 12 months (23%) for CEOs, and 18 months (27%) and 12 months (34%) for other NEOs.

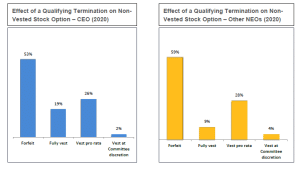

Treatment of Long-Term Incentive Awards

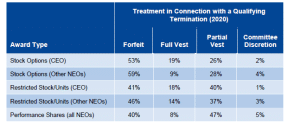

Treatment of long-term incentive with a qualifying termination varies by type of award and, for certain awards, differs between CEOs and other NEOs. Upon a qualifying termination the various LTI instruments are treated as follows:

Executive Severance Arrangements

Executive severance arrangements are a widespread practice among the Study Group. These arrangements provide cash severance and frequently other benefits, including the acceleration of vesting of long-term incentive awards in connection with an NEO’s qualifying termination.

• Prevalence of severance arrangements providing cash severance benefits. 69% of the Study Group disclosed severance arrangements that provide cash severance to one or more NEOs upon a qualifying termination. Unless otherwise indicated, additional statistics presented in this Study are based on the population of Study Group companies that pay cash severance benefits upon a qualifying termination.

• Prevalence of vesting and settlement of long-term incentive awards in connection with a qualifying termination. A majority of the Study Group companies forfeit stock options upon a qualifying termination. In contrast, a majority of the Study Group companies fully or partially vest restricted stock/restricted stock units (“RSUs”) in connection with a qualifying termination. For performance shares, practice is roughly split among Study Group companies between forfeit and full or partial vest in connection with a qualifying termination.

Payment Triggers for Cash Severance Benefits

Among Study Group companies that disclose covering at least one NEO under a severance arrangement, all pay cash severance upon an NEO’s involuntary termination of employment without cause. Approximately half of such companies also pay cash severance to CEOs (and just over 1/3rd to other NEOs) upon a voluntary termination of employment for “good reason”.

The effect of a qualifying termination on non-vested long-term incentive awards is discussed separately in this Study (see pages 11-13).

Cash Severance Benefits

69% of the Study Group disclosed severance arrangements that provide cash severance to one or more NEOs upon a qualifying termination. Of these companies, 85% determine the amount of cash severance

based on a fixed multiple of an NEO’s compensation. The table below shows the different methods used for determining cash severance benefits.

Cash Severance Multiples

For CEOs, a 2× severance multiple is the majority practice (62%). For other NEOs, 40% of companies determine cash severance based on a 2× multiple and 38% determine cash severance based on a 1× multiple.

Definition of Pay Used to Determine Cash Severance Benefits

For CEOs, 73% of companies define pay as the sum of base salary and annual bonus and, for other NEOs, 59% of companies define pay as the sum of base salary and annual bonus.

When a severance formula includes an NEO’s bonus, typically the definition of bonus refers to target bonus (71% prevalence). To a significantly lesser extent (23% prevalence), the definition is based on the bonus actually earned by the NEO (e.g., prior year’s actual bonus, multi-year average).

Stub-Year Bonus

Approximately 61% of Study Group that maintain cash severance arrangements also pay current (stub) year bonuses for the year in which an NEO incurs a qualifying termination either based on actual or target performance. Generally, stub year refers to the year in which an NEO incurs a qualifying termination of employment.

Continuation of Health Care Benefits

The continuation of health care benefits is a common feature of executive severance arrangements. The continuation period for health care benefits often corresponds to an NEO’s cash severance multiple (e.g., 24 months if the cash severance multiple is 2×) or the 18-month COBRA continuation period. However, a minority practice is for the continuation of health care benefits to cease if an NEO becomes eligible for health care benefits with a new employer.

Treatment of Long-Term Incentive Awards

Overview of Long-Term Incentive Awards

This section of the Study examines the effect of a qualifying termination on the following types of long-term incentive awards:

• Stock options (subject to time-based vesting),

• Restricted stock/RSUs (subject to time-based vesting), and

• Performance shares (including share units).

A “performance share” refers to a share-denominated performance-based award that derives its value by reference to the value of a share of common stock. This means one performance share (or share unit) is equal in value to one share of company stock.

Effect of a Qualifying Termination on Long-Term Incentive Awards

Treatment of Stock Options

A majority of the Study Group companies disclosed that non-vested stock options are forfeited upon a qualifying termination for CEOs and other NEOs.

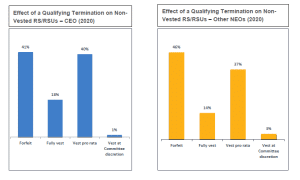

Treatment of Restricted Stock/Restricted Stock Units

Forfieture of restricted stock/restricted stock units upon a qualifying termination is the dominant practice among Study Group companies, with pro rata vesting the next most prevalant practice.

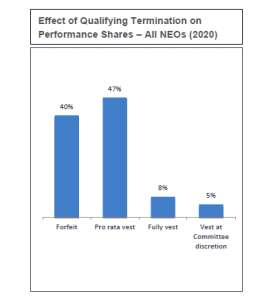

Treatment of Performance Shares

Unlike options and restricted stock/RSUs, the most dominant practice is to pro rata vest performance shares upon a qualifying termination, with forfeiture the next most prevalent practice.

In cases where performance shares fully or pro rata vest in connection with a qualifying termination, the number of shares that vest is most commonly determined based on actual performance (81%).

Appendix – List of S&P 500® Companies in Study Group

Meridian Compensation Partners Profile

Donald Kalfen, a partner of Meridian Compensation Partners, LLC is the principal author of this Study. Other partners and consultants of the firm assisted in the preparation of the Study. Questions and comments regarding the Study should be directed to Mr. Kalfen at dkalfen@meridiancp.com or (847) 235-3605.