Rachael Lee

Rachael Lee

Institutional Shareholder Services (ISS) and Glass Lewis have recently published their 2022 Canadian policy updates.¹ The following is a summary of the key areas of update relating to compensation and governance:

ISS & Glass Lewis – Board Gender Diversity

ISS will recommend voting “withhold” for the Chair of the Nominating Committee (or equivalent/Board Chair) if:

- S&P/TSX Composite Index issuers: women comprise less than 30% of the board and the company has not provided a formal written commitment to achieve this goal prior to the next annual general meeting;

- All other TSX-listed issuers: there are no women on the board and the company has not provided a formal written gender diversity policy.

ISS will evaluate on a case-by-case basis whether “withhold” recommendations are warranted for additional directors at companies that do not meet the above policy for two or more years.²

Glass Lewis will recommend voting “against” the Chair of the Nominating Committee of TSX-listed issuers where there are fewer than two gender diverse directors on the board. If there are no gender diverse directors, it will recommend a negative vote against the entire nominating committee.³

Glass Lewis will carefully review disclosure relating to diversity considerations and may refrain from a negative recommendation if a sufficient rationale, or plan to address the lack of diversity, is provided.

Effective January 1, 2023, Glass Lewis will transition to a percentage-based approach for TSX issuers and will recommend voting against the Chair of the Nominating Committee at companies with less than 30% gender diverse directors.

ISS – Board Responsiveness

ISS updated its “yellow card” voting standard on say-on-pay. It now expects a company to engage with shareholders if the say-on-pay vote support is less than 80% (the prior threshold was 70%). This change aligns with current Glass Lewis policy on company/board responsiveness. Given strong say-on-pay support in Canada (greater than 90% in each of the last five years), this update likely will not impact most companies (8.6% of Canadian issuers received less than 80% support in 2021).

ISS – Pay-for-Performance Test Thresholds

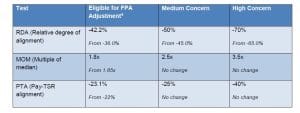

ISS updated its quantitative thresholds for its CEO pay-for-performance tests. There are no other material changes to the basic operation of the quantitative screens for 2022:

These changes will require a higher pay-for-performance disconnect before a company triggers a Cautionary Low Concern on the RDA, MOM, and PTA tests, and before triggering a Medium or High Concern on the RDA test.

ISS – Over-boarded Directors—TSX-V

Effective February 1, 2023, ISS will recommend withholding votes for director nominees who are non-CEO directors and serve on more than five public boards; or are a public company CEO and serve on more than two public company boards besides their own. Since the new guideline is stricter than the current TSX-V standards, a one-year transition period will allow issuers to make appropriate changes to their boards.

ISS – Shareholder Approval of Evergreen Compensation Plans

ISS will recommend “withholding” votes for Compensation Committee members of TSX-V issuers if the company has an evergreen plan (percentage of the outstanding issue reserved), including a plan adopted pre-IPO, and has not sought shareholder approval of the plan in the past two years or at the 2022 meeting.

Glass Lewis – Environmental and Social Risk Oversight

Glass Lewis will recommend voting “against” the Chair of the Governance Committee at TSX60 issuers that fail to provide explicit disclosure of the board’s role in environmental and social risk oversight. For 2022, Glass Lewis will note the same issue as a concern for the balance of the S&P/TSX Composite Index companies, moving to an against recommendation starting January 1, 2023.

Glass Lewis advises that this oversight can be by specific directors, the entire board, a separate committee, or combined with the responsibilities of a key committee.

Glass Lewis – Multi-Class Share Structures with Unequal Voting Rights

Glass Lewis will recommend voting “against” the Chair of the Governance Committee at issuers with a multi-class share structure and unequal voting rights, which do not have a reasonable sunset of the multi- class share structure (generally seven years or less).

Glass Lewis – Size of Key Committees

Glass Lewis will recommend voting “against” the Chair of the Compensation, Nominating and/or Governance Committee if the committee has fewer than two members for the majority of the fiscal year.

Glass Lewis – Clarifying Amendments

In addition to the revisions to the policies noted above, Glass Lewis provided some clarifications to existing policies:

Linking Pay to Environmental/Social Criteria: Glass Lewis does not maintain a policy on the inclusion of E&S metrics in incentive plans. However, where E&S metrics are included, they should be accompanied by robust disclosure on the metrics, rigor of performance targets, and the determination of corresponding payout opportunities. For qualitative E&S metrics, companies should provide shareholders with a thorough understanding of how these metrics are assessed.

Use of Adjusted GAAP: Glass Lewis will consider adjustments to GAAP financial results in its assessment of whether a short-term incentive plan is effective in tying executive pay to performance. Glass Lewis’ analysis of long-term incentive grants also considers the basis for any adjustments to metrics or results. Clear disclosure from issuers is important for both short and long-term incentive awards.

Grants of Front-Loaded Awards: While Glass Lewis continues to examine the quantum of a front-loaded award on an annualized basis for the full vesting period of the award, Glass Lewis clarified that is also considers the impact of the overall size of awards on dilution of shareholder wealth.

- 1 ISS policy is effective for meetings on or after February 1, 2022. Glass Lewis policy is effective for meetings held after January 1, 2022.

- 2 Exemptions will continue to be available for newly-listed TSX issuers, those transitioning from the TSX-V within the current or prior fiscal year, or issuers with four or fewer directors.

- 3 For TSX-V issuers and boards with six or fewer total directors, Glass Lewis will apply a policy requiring a minimum of one gender diverse director in 2022.

- 4 Financial performance assessment (FPA) is a secondary EVA-based test that may be triggered after RDA, MOM, and PTA have been calculated; FPA may impact the overall quantitative screen result.

*******************************

The Client Update is prepared by Meridian Compensation Partners. Questions regarding this Client Update or executive compensation technical issues may be directed to:

Christina Medland at (416) 646-0195, or cmedland@meridiancp.com

Andrew McElheran at (416) 646-5307, or amcelheran@meridiancp.com

Andrew Stancel at (647) 478-3052, or astancel@meridiancp.com

Andrew Conradi at (416) 646-5308, or aconradi@meridiancp.com

Matt Seto at (647) 472-0795, or mseto@meridiancp.com

Rachael Lee at (647) 975-8887 or rlee@meridiancp.com

Kaylie Folias at (416) 891-8951, or kfolias@meridiancp.com

Faiza Mirza at (416) 583-3746 or fmirza@meridiancp.com

Jason Chi at (416) 646-0651, or jchi@meridiancp.com

This report is a publication of Meridian Compensation Partners Inc. It provides general information for reference purposes only and should not be construed as legal or accounting advice or a legal or accounting opinion on any specific fact or circumstances. The information provided herein should be reviewed with appropriate advisors concerning your own situation and issues.

www.meridiancp.com