Donald Kalfen

Donald Kalfen

Report Scope and Study Characteristics

Meridian’s 2024 Study of Executive Severance Arrangements Not Related to a Change in Control (“Study”) provides current information and data on severance practices, not in the context of a Change in Control, of the constituent companies of the Standard & Poor’s 500® Index¹ (“S&P 500®”) as of January 1, 2024 (“Study Group”).

Development of Study Group Statistics

We derived data and information for the Study primarily from Main Data Group and our separate review of annual shareholder proxies filed with the Securities and Exchange Commission by Study Group companies. This data and information relate to severance practices covering named executive officers (“NEOs”)² of Study Group companies. Generally, the Study shows prevalence statistics for the Chief Executive Officer (“CEO”) and average prevalence statistics for the Other Named Executive Officers (“Other NEOs”). Throughout this Study, we reference data according to the fiscal year covered by the proxy statement, not according to the year in which the proxy statement was filed with the SEC.

Study Group Characteristics

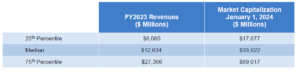

The table below shows, by quartile, fiscal year 2023 revenues and January 1, 2024, market capitalization of the Study Group.

Report Scope

The Study provides prevalence data on the following aspects of Executive Severance Arrangements that cover NEOs: (i) prevalence of Executive Severance Arrangements, (ii) payment triggers, (iii) cash severance benefits, (iv) stub year annual bonus, (v) continuation of health care benefits and (vi) treatment of long-term incentive awards. However, the Study does not take into account benefits that may be payable to an NEO upon death, disability or retirement, or capture potential enhancements that may be negotiated upon actual termination.

Overview of Executive Severance Arrangements

Executive Severance Arrangements refer to any arrangement that provides benefits to an NEO upon a qualifying termination of employment that is not related to or contingent upon a Change in Control.

Rationale for Executive Severance Arrangements

There are important business rationales for maintaining Executive Severance Arrangements, which include the following:

• Attracting executives by providing an appropriate level of financial protection against involuntary job loss,

• Providing a competitive component of compensation,

• Retaining executives through turbulent times and

• Securing restrictive covenants such as non-compete, non-solicitation, etc.

Forms of General Severance Arrangements

Executive Severance Arrangements typically take the form of either: (i) an executive severance plan or policy covering executives by name or by group (the current trend) or (ii) an individual employment contract or severance agreement. Executives also may be eligible to receive severance benefits solely under a broad-based severance plan. Separately, a company’s equity incentive plan or applicable award agreements may provide special treatment of outstanding equity awards upon certain termination of employment events.

Trigger for Executive Severance Benefits

Executive severance benefits are universally triggered upon an executive’s termination of employment without “cause.” Less frequently, executive severance benefits are triggered upon an NEO’s voluntary termination of employment for “good reason.” The lower prevalence is primarily due to company preference to retain flexibility to modify compensation and benefit arrangements, reporting relationships, duties and/or office location over time, without potentially triggering the payment of executive severance benefits.

Types of Executive Severance Benefits

The following are the most common types of severance benefits provided to executives upon a qualifying termination of employment:

• Cash severance,

• Current year bonus,

• Continuation of health care benefits,

• Outplacement services and

• Vesting of long-term incentive compensation.

Restricted Covenants and Release and Waivers of Claims

Often, the payment of severance benefits is conditioned upon an executive’s adherence to restrictive covenants and/or execution of a comprehensive release and waiver of claims. Restrictive covenants may include non-compete, non-solicitation, non-disclosure and non-disparagement provisions. Releases and waivers typically prohibit a departing executive from bringing a lawsuit against the former employer for employment-related causes of actions, including actions under the Age Discrimination in Employment Act.

Key Findings

Prevalence of Executive Severance Arrangements

80% of the Study Group covered at least one NEO under an Executive Severance Arrangement, with 75% of the Study Group covering their Chief Executive Officer under such an arrangement.

Payment Triggers for Cash Severance Benefits

The payment of cash severance is always triggered upon an involuntary termination without “cause” and to a significantly lesser extent upon a voluntary termination for “good reason.”

Cash Severance Benefits

Approximately 90% of companies that maintain Executive Severance Arrangements determined the amount of cash severance payable to the NEOs based on a fixed multiple of “pay”.

• Cash Severance Based on a Fixed Multiple of Pay: For CEOs, a 2x severance multiple was the majority practice (59% of companies) and for other NEOs, a 1x severance multiple was the dominant practice (45% of companies).

• Definition of Pay: The majority practice is to define pay as the sum of base salary and bonus (with bonus typically defined as current year target bonus).

Stub-Year Bonus

58% and 55% of the Study Group that maintain Executive Severance Arrangements disclosed paying (stub) year bonuses for the year in which a CEO and other NEOs, respectively, incur a qualifying termination based on either actual or target performance.

Continuation of Health Care Benefits

80% of the Study Group that maintain Executive Severance Arrangements also disclosed providing continuation of health care benefits for both the CEO and other NEOs. For CEOs, the most prevalent continuation period was 24 months (37%) and for other NEOs the most prevalent continuation period was 12 months (43%), generally consistent with the length of the most common severance multiples/periods.

Treatment of Long-Term Incentive Awards

Treatment of long-term incentive (“LTI”) with a qualifying termination varies by type of award and, for certain awards, differs between CEOs and other NEOs. Upon a qualifying termination the various LTI instruments are treated as follows:

• Stock Options: 54% and 42% of the Study Group disclosed that upon a CEO’s and other NEOs’ qualifying termination of employment, respectively, nonvested stock options become fully or partially vested.

• Restricted Stock/Restricted Stock Units: 59% and 50% of the Study Group disclosed that upon a CEO’s and other NEOs’ qualifying termination of employment, respectively, nonvested restricted stock/restricted stock units become fully or partially vested.

• Performance Shares/Units: 62% and 55% of the Study Group disclosed that upon a CEO’s and other NEOs’ qualifying termination of employment, respectively, nonvested performance shares become fully or partially vested (generally, based on actual performance).

¹ The S&P 500® Index is a registered trademark of S&P Dow Jones Indices LLC, a division of S&P Global, Inc.

² Named executive officers or NEOs refer to a public company’s proxy disclosed chief executive officer, chief financial officer and the three highest paid named executive officers other than the chief executive officer and chief financial officer.