Jim Heim

Jim Heim

In this four-part series, we examine the current state of pre-commercial biotech CEO pay, how it is tailored to the sector, and what drives differences between companies. We will explore:

Part One: Tailoring Pay to the Business

Part Two: Founders vs. Non-Founders

Part Three: East Coast vs. West Coast

Part Four: Drivers of Say-on-Pay Results

We encourage you to review:

- Part One for extensive observations and commentary relating to the pre-commercial biotech business model and how the typical CEO pay program within the sector is tailored to that model—but not necessarily aligned with Proxy Advisory Firm (“PAF”) preferred practices.

- Part Two for an examination of whether founder-led companies within the sector demonstrate distinct CEO compensation programs. Founder CEOs are common among pre-commercial small cap biotechnology companies, and led one-third of the 18 benchmark companies in our study.

Biotech company headquarters are geographically concentrated in urban areas near feeder universities, research hospitals and venture capital. Notable clusters are found in Boston/Cambridge, the San Francisco Bay Area, New York/New Jersey, the DC Area and San Diego.

The resulting concentration of talent drives relatively high local cost-of-labor. An obvious question often posed by compensation committees reflects this dynamic: “Ought we consider geography when selecting executive compensation benchmark peer group companies and paying our executives?”

To assist in these deliberations, Part Three of our series examines whether CEO compensation programs of East Coast companies (including Boston/Cambridge, New York/New Jersey and the DC Area) differ from programs of West Coast companies (primarily San Francisco Bay Area and San Diego).

CEO Pay Program Design: Key Takeaways

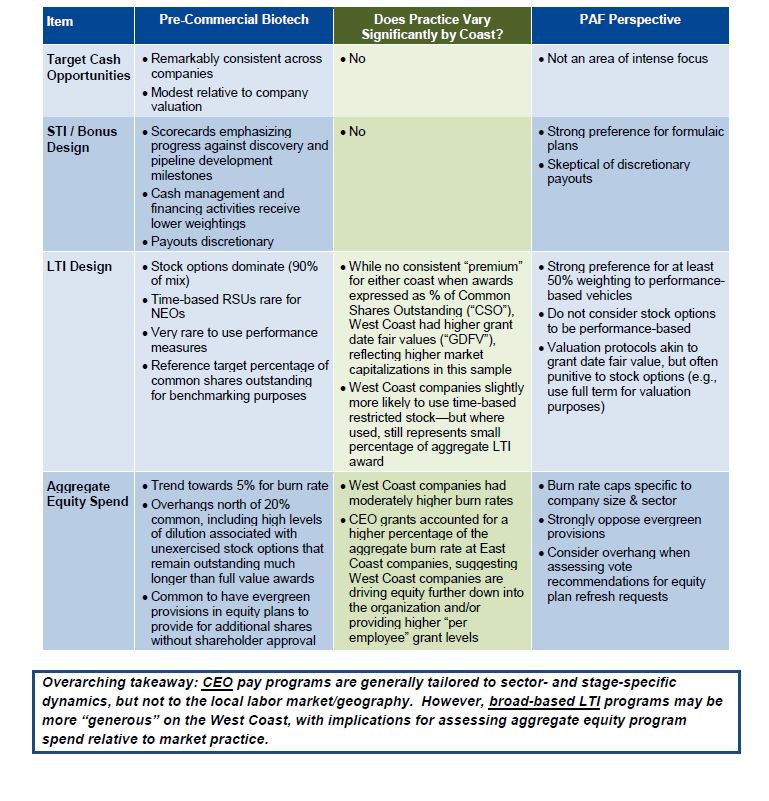

Our research determined that East Coast and West Coast pre-commercial biotech companies compare to broader sector benchmarks and PAF preferred practices as follows:

Developing a Roster of Pre-Commercial Biotech Benchmark Companies

In order to investigate CEO pay practices, we isolated publicly-traded biotech sector companies that:

- Were NYSE or Nasdaq listed;

- Were pre-commercial;

- Had annual meetings that included a SOP vote in the 12 month period ending June 1, 2020; and

- Had no CEO turnover in this period.

Ultimately, we identified 18 companies (listed in the Appendix) with median key statistics including:

West Coast companies were, at median, approximately 2.4x the size of East Coast companies in this sample. This dynamic appeared to impact CEO LTI award grant date fair values (“GDFV”).

In the remainder of this report, we provide further detail relating to general pay practices, bonus/short-term incentive and long-term incentive design for CEOs, and aggregate equity usage statistics for the benchmark companies.

Appendix: Companies Included in Study

ADMA Biologics, Inc.

Adverum Biotechnologies, Inc.

Albireo Pharma, Inc.

AnaptysBio, Inc.

Ardelyx, Inc.

Cellular Biomedicine Group, Inc.

CEL-SCI Corporation

Concert Pharmaceuticals, Inc.

Corbus Pharmaceuticals Holdings, Inc.

Denali Therapeutics Inc.

Dicerna Pharmaceuticals, Inc.

Editas Medicine, Inc.

Fate Therapeutics, Inc.

GlycoMimetics, Inc.

Mirati Therapeutics, Inc.

Pfenex Inc.

Pieris Pharmaceuticals, Inc.

REGENXBIO Inc.