Jamie McGough

Jamie McGough

Abigail Brunks

Abigail Brunks

PERFORMANCE does matter; but it is unclear whether performance plans work. Seventy-five percent of the S&P 500 deliver 50 percent or more of LTI (to senior executives) as “performance awards.” Considerable time, effort, and governance is dedicated to implementing these awards. Is it worth it? Do these performance plans make a difference? Moreover, in the wake of COVID-19 many open cycles are seen as “broken” and unable to adapt to new economic reality. Consequently, it is worthwhile to examine and reflect on whether the outcomes are sufficiently consistent with often stated objectives.

MOTIVATE SUPERIOR PERFORMANCE

Dominant Market Practice

Dominant practice is that ≥50% of LTI are performance awards. Most often, performance awards are share-based, where vesting is contingent on meeting certain performance objectives over a multi-year period—usually three years. Practically speaking, these represent all LTI awards that are not restricted stock or stock options.

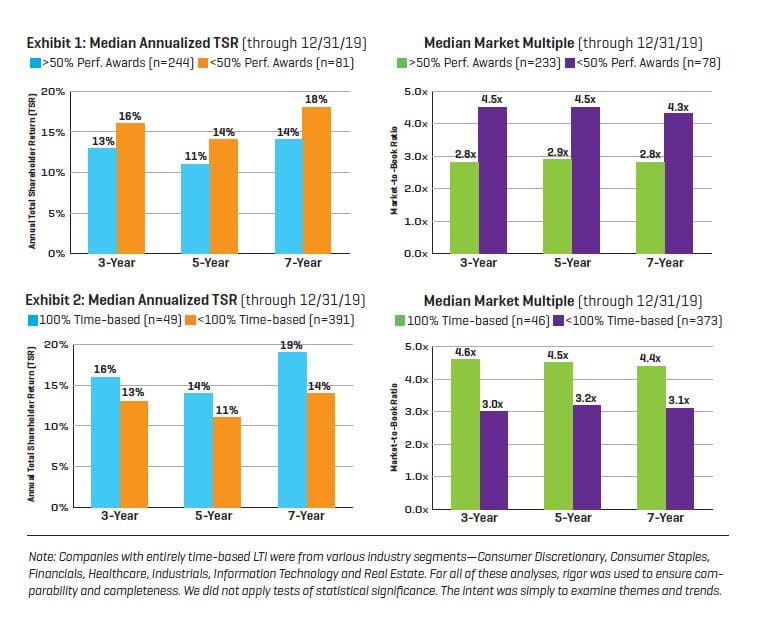

We analyzed both total shareholder return and market-to-book ratios for the last 3-, 5-, and 7-years for companies that maintained this LTI mix for at least the last 5 years. The median performing company granting ≥ 50 percent of LTI in performance awards underperformed the median of those granting less than 50% in performance awards. (See Exhibit I)

TSR is the change in shareholder value over time and is an obvious performance criteria. Market-to-book ratios further distinguish companies with a superior level of value, i.e., those where the value of the stock relative to the invested equity capital reflects particularly promising expectations.

Contrarian Practices

We also examined those companies whose LTI mix are in stark contrast with current norms—companies using 100% time-based awards, i.e., only restricted stock and/or options, no performance awards. These companies outperformed the median of those granting various combinations of performance-based awards both in terms of TSR and market-to-book ratios. (See Exhibit II)

ALIGNMENT

An argument might be made that whether a management team delivers superior performance is secondary. What really matters is that rewards befit performance. There is merit in this argument—to a point. It is sensible that if results are poor that a management team deserves less than if results are strong. However, the premise of dominant market practice is that conventional performance plans have better alignment. Is this so?

It has become prevalent over the last 15 years to view stock options and restricted as not performance based. Is this true? Are they less aligned with shareholders? Do participants behave this way—do they believe they are less aligned? Moreover, over time are goal-based performance plans more likely to yield above target outcomes for what are (overall) average results? These questions are worthy of further analysis—but it is our supposition that the outcomes will be varied and therefore the alignment argument of performance plans is cloudy and somewhat tenuous.

CONCLUSIONS

The overarching purpose of this article is to initiate self-reflection on current practices. Things don’t always remain the same. The structure of LTI today is not what it was 20 years ago. It is worthwhile to reflect whether LTI going forward ought to be what it is today? If not, what are the alternatives and why?

We offer several key takeaways and observations for consideration:

1. Performance matters; performance plans frequently don’t work—shareholder value is paramount; however, conventional performance plans in their duration, complexity and inflexibility often fall short of creating the incentives envisioned.

2. Our analysis is not cause and effect—we are not asserting companies will underperform because they have more than 50% performance awards.

3. LTI does matter, regardless of form—anchoring executives to long-term results is an important philosophical and financial commitment to shareholders.

4. Substantial and long-run stake—material and enduring wealth at risk (think private equity) may matter more than metrics for shareholder alignment and performance.