Eddie Capistran

Eddie Capistran

Michael Brittian

Michael Brittian

Despite being an exceptionally challenging year on many fronts, shareholders of oil & gas companies largely supported 2020 pay decisions, demonstrated with increased support for 2021 Say on Pay (SOP) votes. Based on results published through the end of June 2021, oil & gas companies in the Russell 3000 received 90% support on SOP votes on average, surpassing average votes for S&P 500 companies and aligning closely with all Russell 3000 companies.

Oil & Gas Say on Pay Support Up; General Industry Support Mixed

The chart below shows SOP support for Russell 3000, S&P 500, and oil & gas. While historically, oil & gas SOP votes have tended to lag general industry, for 2021 the industry has largely closed that gap when looking at Russell 3000 support (which has remained fairly steady over the last several years).

It is interesting to note the growing divergence of average support for Russell 3000 and S&P 500 companies. So far this year, there have been a number of high profile failures among S&P 500 companies with a total of 16 failures to date (vs. 12 failures in all of 2020). Much of this appears to be attributable to certain incentive plan adjustments for COVID-19 and a number of large, one-time equity awards to one or more NEOs.

Note: For the remainder of this report our reference to general industry will be focused on Russell 3000 companies.

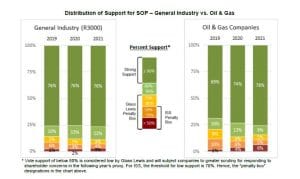

As shown in the charts below, while the distribution of support across general industry has remained fairly consistent over recent years, the percent of oil and gas companies receiving support of 90% or more increased significantly from 69% in 2019 to 76% in 2021. However, these results are somewhat dampened by the fact that there was a notable increase in failed votes (from 2% in 2019 to 6% in 2021). So more oil & gas companies received strong support or really missed the mark – there was less middle ground this year.

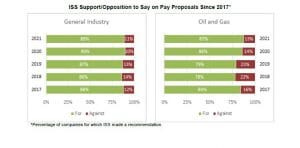

Opposition from ISS Declined

One area that benefited oil & gas companies in 2021 was less opposition from ISS. Over the past several years, the oil & gas industry has received a higher percent of ISS “Against” recommendations than the average for general industry. While this is still the case, the 13% of oil & gas companies facing a negative recommendation for SOP this year was well below the highs of 22% in 2018 and 21% in 2019.

Reduced opposition notwithstanding, the impact of an ISS “Against” remains significant in 2021. As in prior years, an ISS “Against” recommendation this year has resulted in an average reduction of roughly 30 percentage points versus a “For” recommendation for all companies in the Russell 3000. For oil & gas companies, the disparity has been more pronounced, with “Against” companies experiencing an average decline in support of 39 percentage points (more on par with S&P 500 companies to date). Their influence on vote outcomes continues to be significant, and companies that received “Against” recommendations were far more likely to fail Say on Pay (or at the very least receive support below 70%).

2021 Say on Pay Results by Oil & Gas Sub-Industry Show a Wide Range of Outcomes

Storage and Transportation companies fared better on average than companies in other sectors of oil & gas this year. The Storage and Transportation subsector was the only sector with no ISS “Against” recommendations in 2021 and enjoyed an average support of 95%.

On average Drilling companies continue to face the greatest headwinds; however, as of June 30, 2021 only three drillers had disclosed Say on Pay vote results.

Rationale for Positive ISS Vote Recommendations among Oil & Gas Companies

As we reviewed ISS proxy research reports of oil & gas companies in 2021, we observed the following, which likely contributed to increased SOP support:

▪ Lower bonuses paid across the majority of companies (for example, for the first time in many years, CEO bonus payouts among E&P companies averaged below target)

▪ Reduced or flat annual long-term incentive awards for many companies

▪ Few one-time or “special” awards given to executives

▪ Restructuring of short- and long-term incentive designs to align more with shareholder expectations for absolute returns and free cash flow generation (e.g., added/increased weight of free cash flow in the bonus plan, lower focus on volume metrics, increased focus on ESG, new caps or metrics focused on absolute TSR in the long-term plan, etc.)

▪ Companies emerging from bankruptcy largely adopted more progressive and shareholder friendly compensation approaches.

While it’s too early to forecast SOP outcomes in 2022, its possible we could see similar levels of strong support on the heels of further industry recovery and additional incentive plan enhancements designed to respond to industry critics.

Archived copies of previous Energy Insights can be found by going to www.meridiancp.com/insights and selecting Oil & Gas from the dropdown list.