The Basics

Many companies promise contractually to make special payments or provide special benefits to executives at the time of, or upon a qualified termination of employment following, a merger, acquisition or other change in control (CIC) of the company. These payments, such as severance pay, benefits continuation or acceleration of vesting on stock incentives are commonly referred to as golden parachutes. (Further information on golden parachute design can be found under “CIC Severance Arrangements”.)

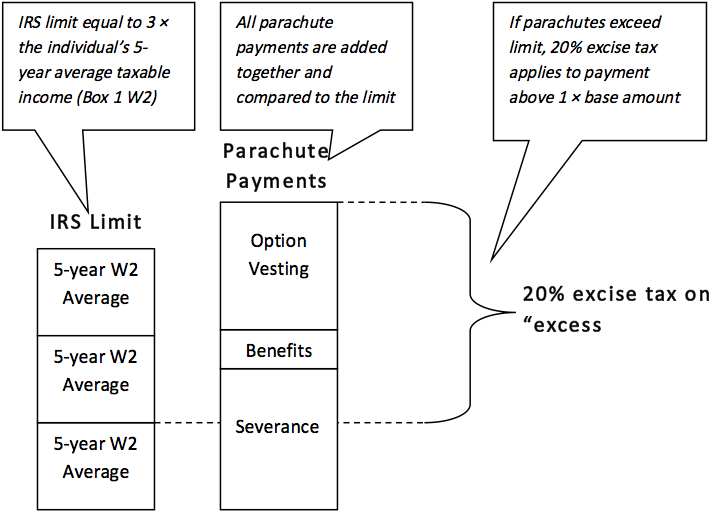

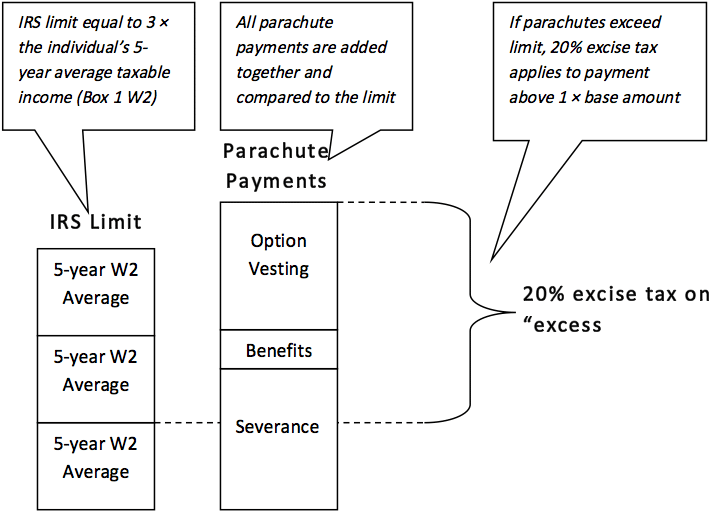

These payments may trigger special excise tax liabilities under Internal Revenue Code Section 280G (280G) if they exceed certain limits. Section 280G classifies payments which are “contingent” upon a change in control of the company as “parachute payments”. If the aggregate parachute payments paid to any “disqualified individual” exceed three times that individual’s five-year average taxable income (base amount), then a 20% excise tax is applied to all parachute payments in excess of one times the individual’s base amount. The illustration below outlines the basics of 280G.

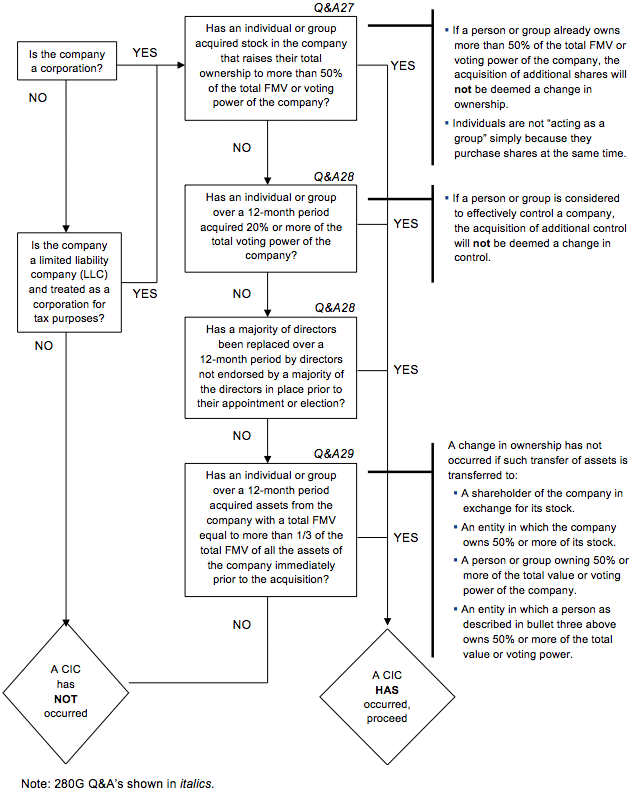

A CIC is generally defined as a merger in which a majority of the company’s shareholders change, a change in the majority of the board of directors or a sale of a substantial portion of the company’s assets.

Key Questions in Determining 280G Liability

In determining an excise tax liability, the following key questions must be considered:

- Has a change in control occurred?

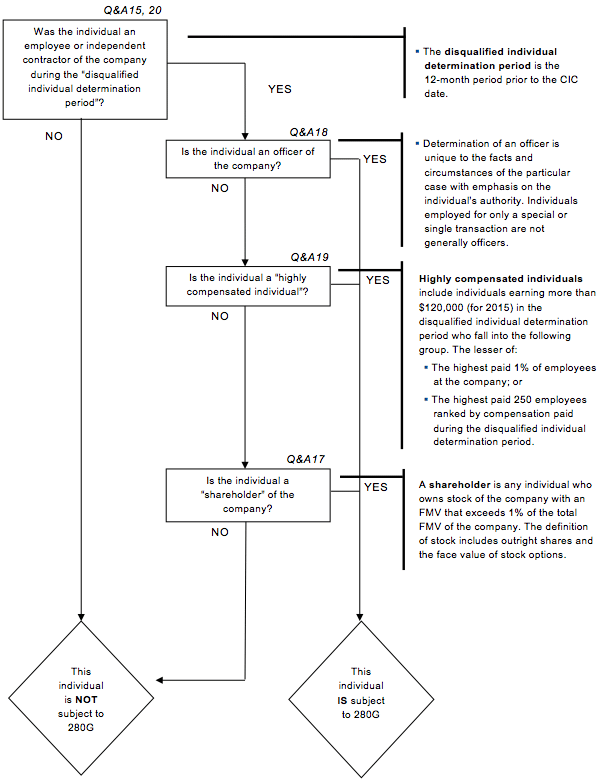

- Who are the disqualified individuals?

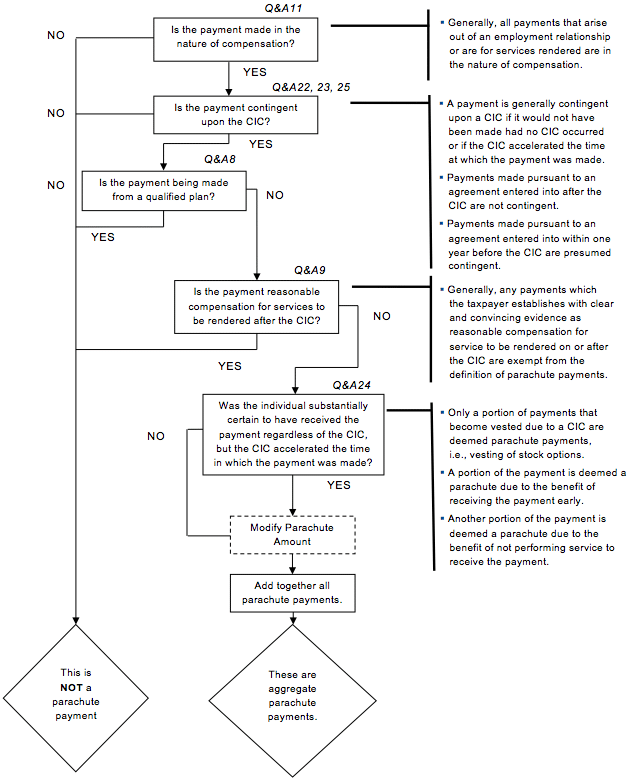

- What are the aggregate parachute payments for each individual?

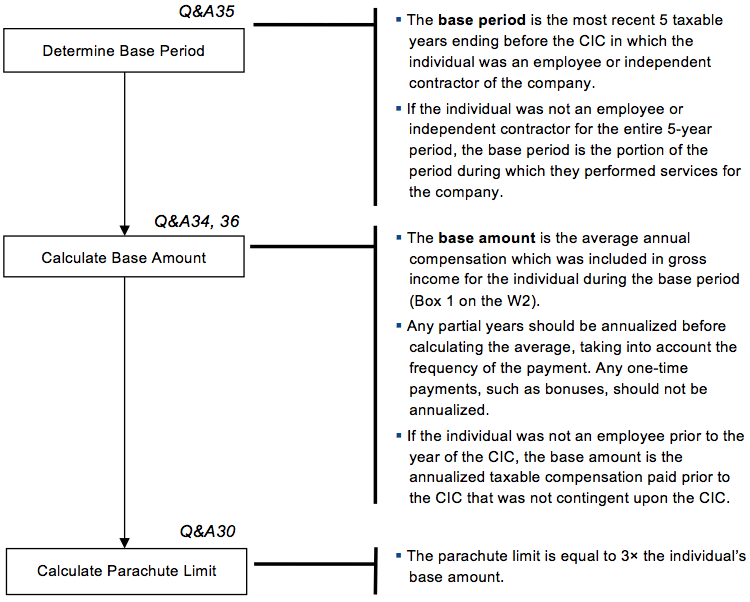

- What is each individual’s base amount and parachute limit?

- How much, if any, excise tax is due?

The Details—Section 280G

Has a change in control occurred?

Who are the disqualified individuals?

What are the aggregate parachute payments for each individual?

What is each individual’s base amount and parachute limit?

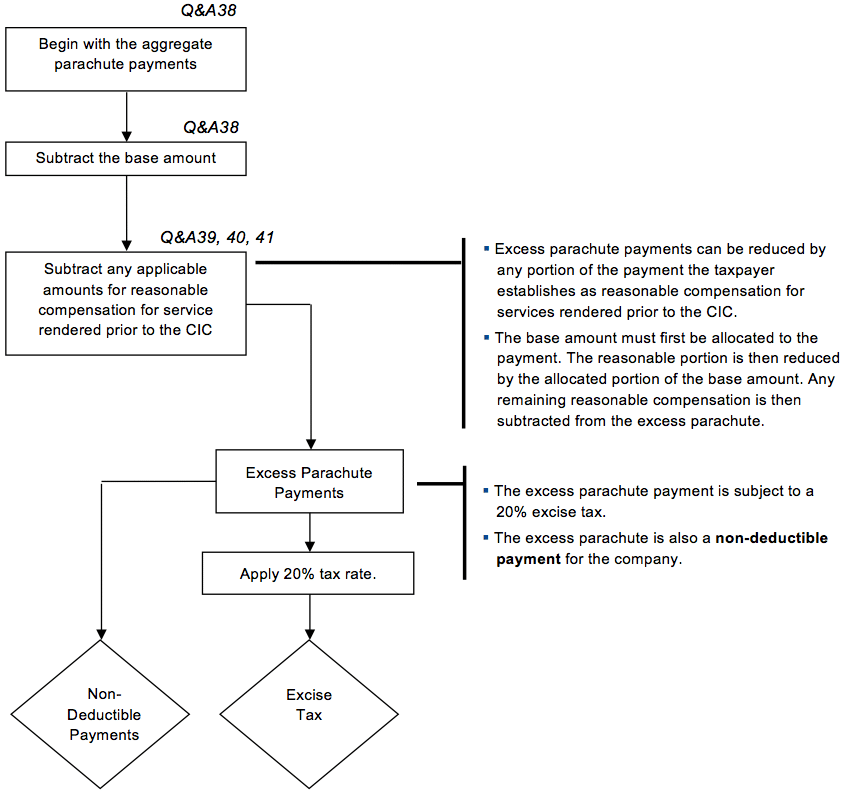

How much, if any, excise tax is due?