Carrie Guenther

Carrie Guenther

Meridian Compensation Partners has issued its eleventh annual Corporate Governance and Incentive Design Survey.

The Survey covers key board governance practices, compensation-related proxy disclosures, and annual and long-term incentive design practices of 200 large cap companies (“Meridian 200”)¹.

Highlights

Governance Practices

- Focus on Corporate Responsibility. 70% of the Meridian 200 disclose internal tracking of long-term sustainability or climate change goals. Additionally, 79% of the Meridian 200 reference their Corporate Responsibility Report in their most recent proxy.

- Increasing Board Diversity. Strong majority (97%) of Meridian 200 companies directly address current board diversity (i.e., ethnicity or gender) in their most recent proxy filing. All Meridian 200 companies have at least one female board member, with 90% disclosing more than 30% female board members. Additionally, 67% of the Meridian 200 companies disclose ethnic diversity statistics for current board membership, up substantially from 35% in 2020.

- Board Member Skill Matrix is Widely Used. 76% of the Meridian 200 companies include a skill matrix in their proxy statement detailing outside directors’ key areas of expertise.

- Mandatory Retirement Age is Typical. 74% of Meridian 200 companies disclose a mandatory age policy for board members, with nearly all companies defining the retirement age between 72 and 75, and a gradual shift to the higher end of this age range in recent years.

- Independent Board Chair is Common. 58% of the Meridian 200 companies separate the Board Chair (CoB) and CEO role. Of those companies that separate the roles, a majority (68%) elect an independent director as CoB, although a recent strong trend toward Executive Chairs has emerged (21% in 2021 vs. 12% in 2020).

- Lead Director Pay Increasing. Of the Meridian 200 companies that pay additional fees to Lead Directors, 53% pay between $30,001-$50,000. The increase in Lead Director fees implies an increasing level of responsibility and time commitment for those Directors.

Proxy Disclosures

- Few Compensation-Related Shareholder Proposals. Only 8% of Meridian 200 companies’ 2021 proxies included one or more compensation-related shareholder proposals. Of these proposals, the most prevalent related to pay disparity between executives and other employees (25%). The great majority of compensation-related shareholder proposals receive limited shareholder support.

- Growing Shareholder Outreach. In 2021, 88% of Meridian 200 companies disclosed shareholder outreach efforts, with almost one-half (43%) providing specific detail on feedback received, number or percentage of major institutional investors that were contacted and/or actions taken.

Annual Incentive Plan Design Practices

- The most prevalent performance metrics continue to be Operating Income, Revenue, Cash Flow and Earnings per Share (EPS).

- The use of corporate/strategic goals increased to 55% in 2021. This is primarily due to an increase in companies adding ESG metrics to their short-term plans.

― 36% of the Meridian 200 include ESG metrics as a weighted corporate performance metric in their annual incentive plans. Note: For purposes of this survey, ESG includes safety, environmental and diversity & inclusion metrics, but does not include other operational metrics such as customer satisfaction.

Long-Term Incentive Plan Design and Vehicle Mix Practices

- 97% of Meridian 200 companies grant performance-based vehicles as part of their long-term incentive plans (most often Performance Share Units or PSUs), with performance measured over a multi-year period (typically 3 years).

- The 2021 average mix of LTI awards for CEOs changed little from 2020, with the majority of LTI mix delivered in performance-based shares/units (61%) and the remainder of in time-vesting shares (22%) and stock options (17%).

― Use of time-vesting shares increased slightly in 2020, often as a result of COVID-19 and continued uncertainty of company performance.

- Relative Total Shareholder Return (rTSR) continues to be the most prevalent (74%) metric in performance-based LTI plans with a trend toward increased use as a payout modifier (40% prevalence) versus a weighted component (63% prevalence).

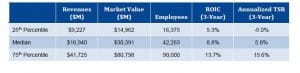

Following are statistics of the Meridian 200 companies. All figures shown are as of the end of fiscal year 2020.

This Survey was authored by Carrie Guenther and other consultants of Meridian Compensation Partners, LLC. Questions and comments on the Survey should be directed to Ms. Guenther at cguenther@meridiancp.com or (847) 235-3622.

* * * * *

This report is a publication of Meridian Compensation Partners, LLC, provides general information for reference purposes only, and should not be construed as legal or accounting advice or a legal or accounting opinion on any specific fact or circumstances. The information provided herein should be reviewed with appropriate advisors concerning your own situation and issues.