Bob Romanchek

Bob Romanchek

Adam Hearn

Adam Hearn

This year has been extraordinary in many respects, given the convergence of the COVID-19 disease, substantial oil price declines, and the collapse of brick and mortar retail, among other industries. The result on company pay programs has also been dramatic, with furloughs, layoffs, bonus elimination and temporary pay reductions, and declining equity valuations.

Executive compensation programs have not been immune from the effects of these events, with many hard-hit companies forecasting little to no payouts under their short-term bonus and long-term performance plans for 2020 and seeing the retention value of outstanding equity awards significantly decline due to stock price decreases. In many cases, outside director cash retainers have also been reduced.

To address the foregoing issues, some companies are considering resetting 2020 bonus plan goals, adjusting 2020 payouts at year-end under performance equity arrangements and reinstating base pay reductions. Given the immediacy and the materiality of these pay issues, it is easy to lose sight of the longer-term philosophical purpose and appropriate ongoing design of the incentive compensation components of a properly aligned executive compensation program.

For executives, the short- and long-term incentive programs are the largest and most important pay components to align interests with shareholders to attract and retain key talent and to promote the achievement of specific strategic goals. So, looking forward to 2021, and looking backward on the COVID-19 situation, companies should get back to the basics of incentive compensation design.

Short-Term Incentives

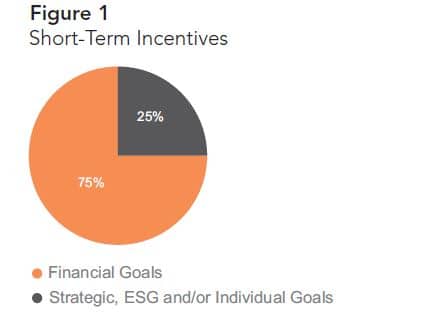

In “normal” times, the most common design approach for an executive short-term incentive plan includes using one or two company-wide financial goals for approximately 75% of the annual bonus opportunity. The remaining 25% is allocated to the achievement of strategic, individual or environmental, social and governance (ESG) type goals. This approach provides focus for executives on important company-wide financial goals, which shareholders, analysts and governance firms prefer. This also allows for promotion of key strategic accomplishments, ESG goals and differentiation for individual performance.

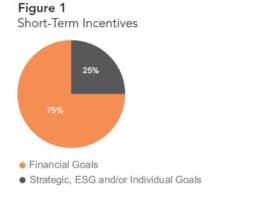

The most common financial goals in short-term incentive plans center around income statement earnings—with specific focus at different levels within the “profit and loss” statement, depending upon a multitude of factors. For example, if the goal is to acquire market share, net revenues may be appropriate. Conversely, if the goal is to improve variable costs, operating income or operating free cash flow may be the answer. As you move down the income statement, different categories of expenses are considered, with EBIT and EBITDA goals. Bottom line net income is all cost inclusive. For 2021, given more limited earnings visibility than in most years, we expect more conservative goal setting and broader performance ranges for short-term incentive plans.

Long-Term Incentives

Also in “normal” times, the most common design approach for an executive long-term incentive (LTI) plan includes the grant of two or three LTI vehicles, with 50% or more of the target LTI grant value composed of performance based equity awards. Typically, the remainder of the target LTI grant value is composed of time-based restricted stock/units, which help to retain executives and align executive interests with those of stockholders. In certain industries (e.g., high tech), companies often grant stock options to incent and reward high growth and share price appreciation.

Most of the redesign activity in the long-term incentive pay component is occurring in the performance vehicle. Weighting of this vehicle is expected to tick down somewhat (given the ongoing lack of financial visibility to sufficiently set three-year fixed goals), in favor of the time vested restricted stock/unit vehicle.

However, financial goals utilized in the performance-based vehicle are not expected to change materially, as these goals continue to be aligned with intermediate and long-term company strategic objectives.

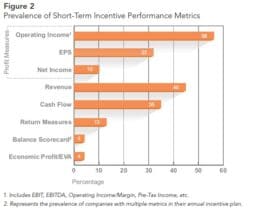

The most common financial goals in LTI programs continue to use a relative

total shareholder return (TSR) concept. However, prevalence of the use of

relative TSR has leveled off, and may experience somewhat of a decrease, due to the high level of volatility in the stock market. To offset the external market risk of using relative TSR by itself, many companies are now pairing a relative TSR measure with a more traditional company-wide financial goal such as EPS, or return on invested capital. Also, companies are increasingly using relative TSR as a modifier instead of a baseline measure. Balance sheet “return” type measures are also more prevalent in long-term incentive programs, versus short-term, given the longer-term decision-making nature of return goals. In addition, for long-term performance plans starting in 2021, we expect broader performance and payout ranges around target.

Conclusion

As we move forward into 2021, executive incentive compensation design will need to get back to the basics to promote shareholder alignment, executive retention and to incent the achievement of important company strategic goals.

Note: All data cited in the graphs and charts are from a Meridian private survey of over 200 large publicly traded companies across a variety of industries.