David Bixby

David Bixby

In August 2020 the SEC issued a new rule requiring public companies to disclose information on their human capital resources. The final rule is principles-based and materiality-based; the SEC identified examples of potentially material subjects that included attraction, retention and development of talent, but declined to be more prescriptive. The resulting flexibility of the guidelines opened the door for a potentially wide range of responses in FY 2020 10-K filings.

We recently reviewed 2020 filings for a group of 76 exploration & production, oilfield services, and midstream oil & gas companies to see how companies in the oil and gas sector addressed the new disclosure requirements. In our review we did find significant variation in terms of length and depth of disclosure, which is not a surprising outcome given the range of company sizes and staffing models in our sample. However, we also found many similarities in terms of the topics companies chose to focus on across all three sectors.

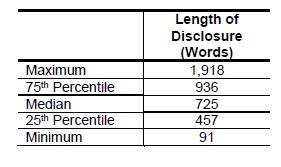

Length of Disclosure

The median disclosure included 725 words, although there was wide variation. The shortest disclosure was less than 100 words essentially repeating disclosure from the prior year’s 10K. The longest was a nearly 2,000 word disclosure that included tabular breakdowns of workforce diversity, employee (global) geographic distribution, and sources of recruiting/talent. There was no meaningful correlation between length of disclosure and industry sector, total employment, or market cap. While more difficult to quantify, there also appeared to be little correlation between length of disclosure and the variety of human-capital related topics covered (excluding a few outliers); more words did not always mean that a company had materially more to say on the subject of human capital.

Key Areas of Focus

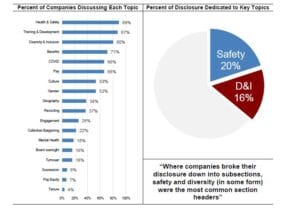

Guided perhaps by the SEC’s non-exhaustive list of suggestions, companies in our sample tended to focus on similar subject matter – safety, diversity and talent development being most popular. Where companies broke their disclosure down into subsections, safety and diversity (in some form) were the most common section headers. However, only a minority of companies (<30%) included statistics regarding either ethnic or gender diversity, and fewer provided a breakdown by employee level (percent of executive leadership, percent of managerial employees, etc.). Very few companies explicitly mentioned the topic of pay equity.

The charts below summarize the prevalence of various topics across our entire sample, and the amount of “real estate” dedicated to safety and diversity.

What to Expect Next

As with any new disclosure requirement, companies will be looking closely at peer filings for guidance on how to refine and improve their own disclosures for 2021. Companies will likely also be hearing from stakeholders with questions about what was discussed…and what was left out. With that feedback in hand, and with increased awareness and reporting on key HCM statistics at the Board level, expect to see certain items on our list above receive greater attention next year:

• The Board’s role in overseeing human capital management (HCM)

• The connection between HCM, healthy culture, and business strategy

• More detailed discussion of diversity and inclusion initiatives

• More specific diversity statistics, and more discussion of pay equity

FY 2020 disclosures are just the starting point for a more thoughtful discussion about a subject that is certain to receive increased scrutiny going forward – from the field all the way to the C-Suite and the Board room.

Archived copies of previous Energy Insights can be found by going to www.meridiancp.com/insights and selecting Oil & Gas from the dropdown list.